Focus Universal Inc.

2311 East Locust Court

Ontario, CA 91761

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Rule 14a-101)

INFORMATION REQUIRED IN A PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e) (2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule of Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

|

Focus Universal Inc. 2311 East Locust Court |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 20, 2025

Dear Focus Universal Shareholders,

The 2025 Annual Meeting of Shareholders (the “Annual Meeting”) of Focus Universal Inc. (the “Company”) will be held at the Company’s headquarters located at 2311 East Locust Court, Ontario, California 91761 on Friday, June 20, 2025, at 2:00 p.m., Pacific Daylight Time, to consider and act upon the following matters:

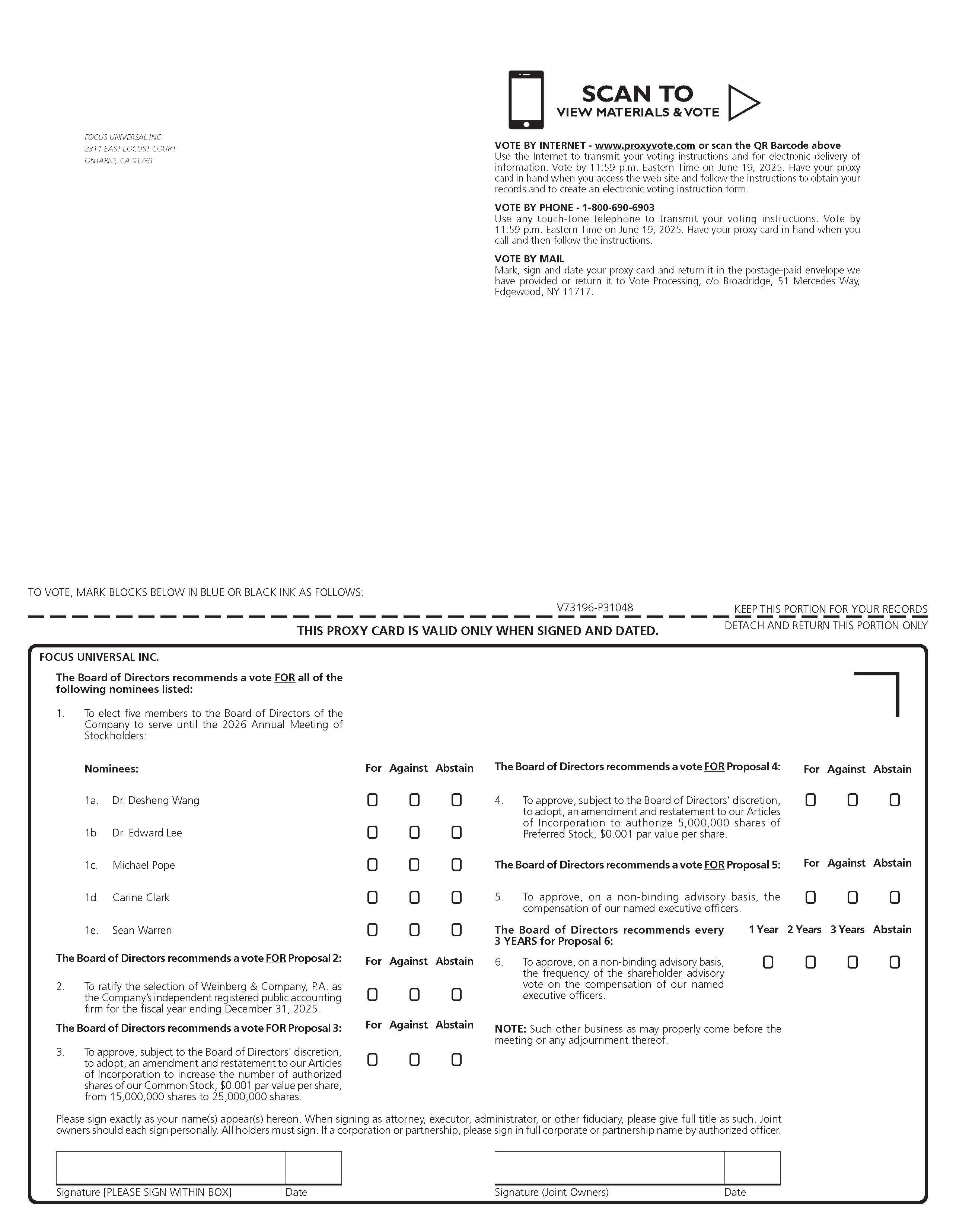

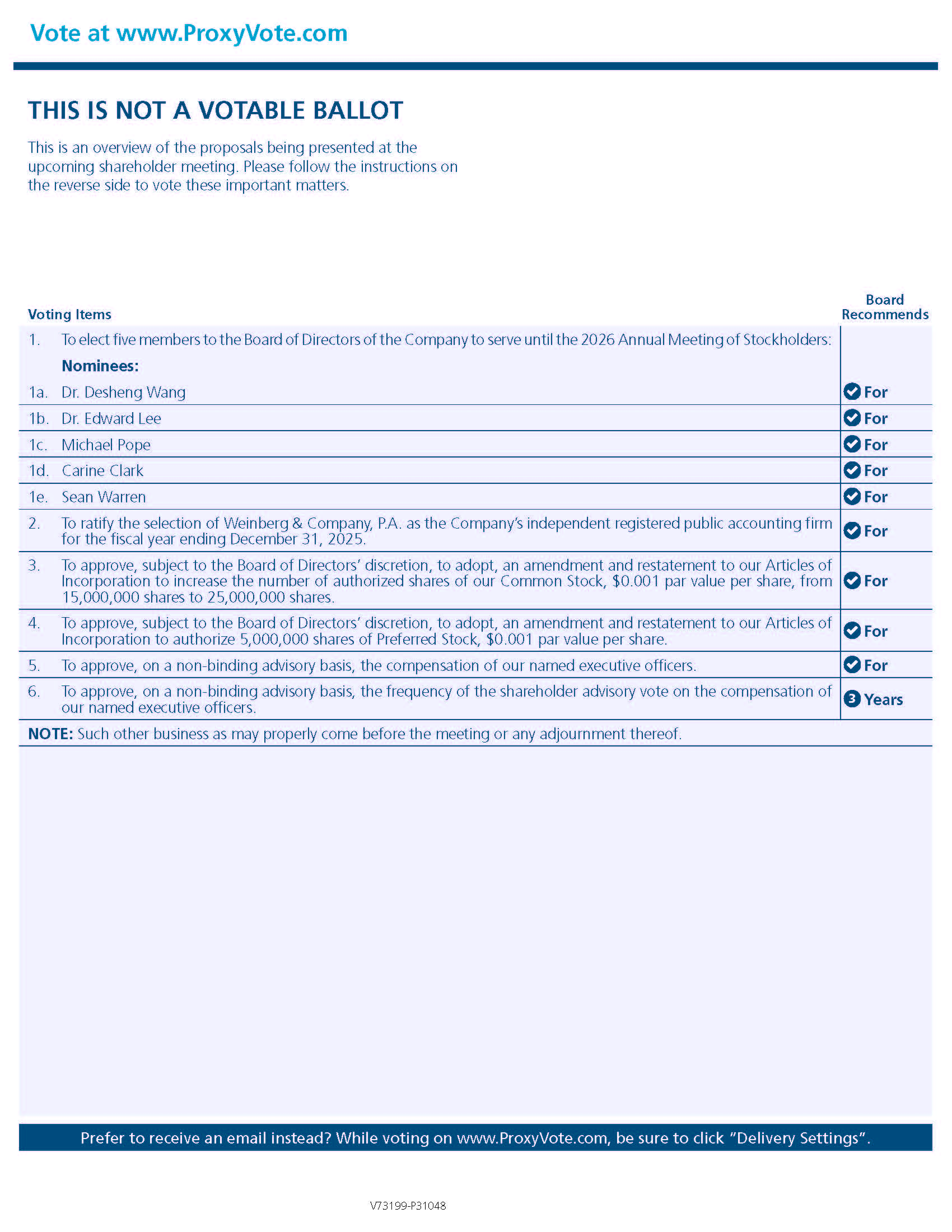

| 1. | To elect five (5) members to the Board of Directors of the Company to serve until the 2026 Annual Meeting of Shareholders; |

| 2. | To ratify the selection of Weinberg & Company, P.A. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025; |

| 3. | To approve, subject to the Board of Directors’ discretion, to adopt, an amendment and restatement to our Articles of Incorporation to increase the number of authorized shares of our common stock, $0.001 par value per share, from 15,000,000 shares to a total of 25,000,000 shares; | |

| 4. | To approve, subject to the Board of Directors’ discretion, to adopt, an amendment and restatement to our Articles of Incorporation to authorize 5,000,000 shares of preferred stock, $0.001 par value per share; | |

| 5. | To approve, on a non-binding advisory basis, the compensation of our named executive officers; | |

| 6. | To approve, on a non-binding advisory basis, the frequency of the shareholder advisory vote on the compensation of our named executive officers; and | |

| 7. | To transact such other business as may properly come before the meeting or any adjournment or postponements thereof. |

The Board of Directors of the Company has fixed the close of business on April 21, 2025, as the record date (the “Record Date”) for determining shareholders entitled to notice of and to vote at the Annual Meeting.

YOUR VOTE IS VERY IMPORTANT. YOU MAY VOTE BY MAIL, THROUGH THE INTERNET, BY TELEPHONE OR BY ATTENDING THE ANNUAL MEETING AND VOTING BY BALLOT, ALL AS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT.

The accompanying proxy statement provides a detailed description of the Proposals. We urge you to read the accompanying proxy statement, including the appendices, carefully and in their entirety. If you have any questions concerning the Proposals or the accompanying proxy statement of which this notice forms a part, or if you would like additional copies of the accompanying proxy statement, please contact the Secretary of Focus Universal Inc. at (626) 272-3883.

| i |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 20, 2025. This Notice of Annual Meeting of Shareholders, the Proxy Statement, and our Form 10-K are available online at http://www.proxyvote.com. The Company intends to mail the Notice of Annual Meeting and accompanying Proxy Statement to shareholders on or about the Record Date.

Whether or not you plan to attend the Annual Meeting, please sign, date and return the enclosed proxy card in the prepaid envelope provided, as soon as possible, so your shares can be voted at the meeting in accordance with your instructions. If you prefer, you may instead vote electronically through the internet or by telephone. The instructions on your proxy card describe how to use these convenient services. Your vote is important no matter how many shares you own. If you plan to attend the Annual Meeting and wish to vote your shares personally, you may do so at any time before your proxy is voted. The Company asks that shareholders planning to attend the Annual Meeting notify the Company at least 48 hours in advance of the meeting by calling (626) 272-3883. Your prompt cooperation is greatly appreciated.

All shareholders as of the Record Date are cordially invited to attend the Annual Meeting.

Admission to Annual Meeting

Attendance at the Annual Meeting is limited to shareholders of the Company as of the Record Date. For safety and security reasons, video and audio recording devices and other electronic devices will not be allowed in the meeting. If your shares are held in the name of your bank, brokerage firm or other nominee, you must bring to the Annual Meeting a copy of your proxy card, an account statement, or a letter from the nominee indicating that you beneficially owned the shares as of the Record Date for voting. If you do not have proof of share ownership, you will not be admitted to the Annual Meeting.

For registered shareholders, a copy of your proxy card can serve as verification of stock ownership. Shareholders who do not present a copy of their proxy card at the Annual Meeting will be admitted only upon verification of stock ownership, as indicated herein. If you do not have proof of share ownership, you will not be admitted to the Annual Meeting. In addition, all Annual Meeting attendees will be asked to present valid government-issued photo identification, such as a driver’s license or passport, as proof of identification before entering the Annual Meeting, and attendees may be subject to security inspections.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Desheng Wang

Desheng Wang

Chief Executive Officer and Secretary

April 18, 2025

| ii |

TABLE OF CONTENTS

| iii |

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 20, 2025

INTRODUCTION

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Focus Universal Inc. (the “Company”) of proxies to be voted at the 2025 Annual Meeting of Shareholders of the Company (the “Annual Meeting”) to be held at the Company’s headquarters located at 2311 East Locust Court, Ontario, California 91761 at 2:00 p.m., Pacific Daylight Time, on Friday, June 20, 2025 and at any adjournment or postponement thereof (the “Proxy Statement”). This Proxy Statement and the accompanying proxy card are being mailed to shareholders commencing on or about the Record Date. Only the holders of our “Common Stock” at the close of business on April 21, 2025 (the “Record Date”), will have the right to vote at the Annual Meeting.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

The following are some questions that you, as a shareholder of the Company, may have regarding the Annual Meeting, together with brief answers to those questions. We urge you to read carefully the remainder of this Proxy Statement, including the appendices and other documents referred to in this Proxy Statement, because the information in this section may not provide all of the information that might be important to you with respect to the Annual Meeting.

| Q: |

Why am I receiving these materials?

| |

| A: | The Company is sending these materials to its shareholders to help them decide how to vote their shares of Common Stock with respect to the Proposals to be considered at the Annual Meeting of the Company’s shareholders to be held on June 20, 2025, which we refer to as the “Annual Meeting,” and you should read them carefully. | |

| Q: |

Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

| |

| A: |

In accordance with rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we may furnish proxy materials, including this Proxy Statement and our Annual Report on Form 10-K, to our shareholders by providing access to such documents on the internet instead of mailing printed copies. Most shareholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials (the “Notice”), which was mailed to the holders of our common stock, par value $0.001 per share (the “Common Stock”), will instruct you as to how you may access and review all of the proxy materials on the internet. The Notice also instructs you as to how you may submit your proxy on the internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice.

The Notice of the Annual Meeting, Proxy Statement, and Annual Report on Form 10-K are available online at www.proxyvote.com. | |

| Q: |

When and where will the Annual Meeting take place?

| |

| A: | The Annual Meeting will be held on June 20, 2025, at 2:00 p.m., local time, at 2311 East Locust Court, Ontario, California 91761. | |

| Q: |

Who can attend and vote at the Annual Meeting?

| |

| A: |

The Company’s shareholders of record as of the close of business on April 21, 2025, the Record Date for the Annual Meeting, are entitled to receive notice of, attend, and vote at the Annual Meeting.

If your shares are held in the name of your bank, brokerage firm or other nominee, you must bring to the Annual Meeting a copy of your proxy card, an account statement, or a letter from the nominee indicating that you beneficially owned the shares as of the Record Date for voting. If you do not have proof of share ownership, you will not be admitted to the Annual Meeting.

For registered shareholders, a copy of your proxy card can serve as verification of stock ownership. Shareholders who do not present a copy of their proxy card at the Annual Meeting will be admitted only upon verification of stock ownership, as indicated herein. If you do not have proof of share ownership, you will not be admitted to the Annual Meeting. In addition, all Annual Meeting attendees will be asked to present valid government-issued photo identification, such as a driver’s license or passport, as proof of identification before entering the Annual Meeting, and attendees may be subject to security inspections. |

| 1 |

| Q: | What will be voted on at the Annual Meeting? |

| A: | At the Annual Meeting, the shareholders will be asked: | |||

| · | To elect five (5) members to the Board to serve until the 2026 Annual Meeting of Shareholders (the “Election of Directors Proposal”); | |||

| · | To ratify the selection of Weinberg & Company, P.A. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025 (the “Auditor Ratification Proposal”); | |||

| · | To approve, subject to the Board of Directors’ discretion, to adopt, an amendment and restatement to our Articles of Incorporation to increase the number of authorized shares of our common stock, $0.001 par value per share (“Common Stock”), from 15,000,000 shares to a total of 25,000,000 shares (the “Common Stock Proposal”); | |||

| · | To approve, subject to the Board of Directors’ discretion, to adopt, an amendment and restatement to our Articles of Incorporation to authorize 5,000,000 shares of preferred stock, $0.001 par value per share (“Preferred Stock”) (the “Preferred Stock Proposal”); | |||

| · | To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers (the “Say-on-Pay Proposal”); | |||

| · |

To approve, on a non-binding advisory basis, the frequency of the shareholder advisory vote on the compensation of the Company’s named executive officers (the “Say-on-Pay Frequency”); and

| |||

| · | To transact such other business as may properly come before the meeting or any adjournment or postponements thereof (the “Additional Proposals”). | |||

| Collectively, the Election of Directors Proposal, Auditor Ratification Proposal, Common Stock Proposal, Preferred Stock Proposal, Say-on-Pay Proposal, Say-on-Pay Frequency Proposal, and any Additional Proposals are referred to in this Proxy Statement as, the “Proposals.” |

| Q: |

What do I need to do now and how do I vote?

| |

| A: |

The Company urges you to read this proxy statement carefully, including the appendices, and to consider how the Proposals described in this proxy statement may affect you and the Company as a whole.

To vote, you may provide your proxy instructions in three (3) different ways. First, you can mail your signed proxy card in the enclosed return envelope. Alternatively, you can provide your proxy instructions by calling the toll-free call center set up for this purpose indicated on the enclosed proxy card and following the instructions provided. Please have your proxy card available when you call. Finally, you can provide your proxy instructions over the Internet by accessing the website indicated on the enclosed proxy card and following the instructions provided. Please have your proxy card available when you access the web page. Please provide your proxy instructions only once and as soon as possible so that your shares can be voted at the Annual Meeting. | |

| 2 |

| Q: | What vote is required to approve each Proposal? |

| A: | The following votes are required to approve the Proposals: | |||

| · | A plurality vote of the holders of the shares of Common Stock represented in person or by proxy and voting at the Annual Meeting, a quorum being present, is required for the Election of Directors Proposal. | |||

| · | The affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy and voting at the Annual Meeting is necessary for the approval of the Auditor Ratification Proposal. | |||

| · | The affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy and voting at the Annual Meeting is necessary for the approval of the Common Stock Proposal. | |||

| · | The affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy and voting at the Annual Meeting is necessary for the approval of the Preferred Stock Proposal. | |||

| · | The affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy and voting at the Annual Meeting is necessary for the approval of the Say-on-Pay Proposal. | |||

| · |

The affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy and voting at the Annual Meeting is necessary for the approval of the Say-on-Pay Frequency Proposal.

| |||

| · | The affirmative vote of the holders of a majority of the shares of Common Stock represented in person or by proxy and voting at the Annual Meeting is necessary for the approval of any Additional Proposals, if so brought forth. | |||

| Q: |

Will any other business be presented for action by shareholders at the Annual Meeting?

| |

| A: | Management knows of no business that will be presented at the Annual Meeting other than the Proposals. If any other matter properly comes before the Annual Meeting, the persons named as proxies in the proxy card intend to vote the proxies (which confer discretionary authority to vote on such matters) in accordance with their judgment on the matter. |

| Q: | How does the Company’s Board of Directors recommend that the Company’s shareholders vote with respect to the Proposals? |

| A: | The Company’s Board of Directors, which we refer to as the “Board,” recommends that the Company’s shareholders vote: | |||

| · | “FOR” the Election of Directors Proposal; | |||

| · | “FOR” the Auditor Ratification Proposal; | |||

| · | “FOR” the Common Stock Proposal; | |||

| · | “FOR” the Preferred Stock Proposal; | |||

| · | “FOR” the Non-Binding Say-on-Pay Proposal; and | |||

| · | “FOR” the Non-Binding Say-on-Pay Frequency Proposal. | |||

| 3 |

| Q: |

Why does the Board of Directors recommend approval of the Common Stock Proposal and Preferred Stock Proposal?

| |

| A: | The Board believes that the Common Stock Proposal and Preferred Stock Proposal are in the Company’s best interests because they would increase the number of shares of authorized Common Stock and authorize the issuance of Preferred Stock. This added flexibility would allow the Company to issue shares of Common Stock and/or Preferred Stock in the future as needed for various corporate purposes, including, but not limited to, raising capital, engaging in strategic transactions, such as mergers, acquisitions, partnerships, joint ventures, divestitures, and other business combinations, effectuating stock splits or stock dividends, as well as other general corporate transactions, and providing equity incentive grants under employee stock plans. | |

| Q: |

Where can I find the voting results of the Annual Meeting?

| |

| A: | The Company intends to announce preliminary voting results at the Annual Meeting and publish final results in a Current Report on Form 8-K that will be filed with the SEC following the Annual Meeting. All reports the Company files with the SEC are publicly available when filed. | |

| Q: |

What happens if I do not return a proxy card or otherwise provide proxy instructions?

| |

| A: |

If you do not submit a proxy card, provide proxy instructions by telephone or over the Internet or vote at the Annual Meeting, your shares will not be counted as present for the purpose of determining the presence of a quorum, which is required to transact business at the Annual Meeting.

If you sign, date and mail your proxy card without indicating how you wish to vote, your proxy will be counted as present for the purpose of determining the presence of a quorum for the Annual Meeting and all of your shares will be voted “FOR” the Proposals. However, if you submit a proxy card or provide proxy instructions by telephone or over the Internet and affirmatively elect to abstain from voting, your proxy will only be counted as present for the purpose of determining the presence of a quorum for the Annual Meeting. | |

| Q: |

If my shares are held in “street name” by a broker or other nominee, will my broker or nominee vote my shares for me?

| |

| A: |

If a shareholder is not the record holder, such as where the shares are held through a broker, bank or other financial institution, the shareholder must provide voting instructions to the record holder of the shares in accordance with the record holder’s requirements in order to ensure the shares are properly voted. Your broker will not be permitted to vote on your behalf, unless you provide specific instructions by completing and returning the voting instruction form or following the instructions provided to you to vote your shares. For your vote to be counted, you now will need to communicate your voting decisions to your broker, bank or other financial institution before the date of the shareholders meeting.

If you hold shares through an account with a broker, bank or other nominee, and you fail to provide voting instructions to your broker, bank or other nominee either using your voting instruction card or by telephone or over the Internet, in accordance with the instructions provided, then your shares will not be voted with respect to any of the proposals being considered at the Annual Meeting. Therefore, if you hold shares through a broker, bank or other nominee it is important that you provide your broker, bank or other nominee with your voting instructions. | |

| Q: |

What is an abstention?

| |

| A: | An abstention is a shareholder’s affirmative decision to decline voting on a proposal. Pursuant to Nevada law, abstentions are counted as shares present and entitled to vote at the Annual Meeting. Unless applicable law dictates otherwise, our Bylaws provide that an action by our shareholders is approved by a majority of votes cast (other than the election of directors) by the holders of shares entitled to vote in favor of such action. Therefore, any votes to abstain will not count as a vote “FOR” or “AGAINST” a director, because directors are elected by plurality voting. A vote marked as “ABSTAIN” for the remaining Proposals is not considered a vote cast and will therefore not affect the outcome of Proposals 2, 3, 4, 5, or 6. | |

| 4 |

| Q: |

May I vote in person?

| |

| A: |

If you hold shares of Common Stock that are registered directly in your name with the Company’s transfer agent, you are considered, with respect to those shares, the “shareholder of record,” and the proxy materials and proxy card are being sent directly to you. If you are the shareholder of record, you may attend the Annual Meeting and vote your shares in person, rather than signing and returning your proxy card or otherwise providing proxy instructions by telephone or over the Internet.

If your shares of Common Stock are held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you together with a voting instruction card. As the beneficial owner, you are also invited to attend the Annual Meeting. However, since a beneficial owner is not the shareholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker or other nominee that holds your shares giving you the right to vote the shares in person at the Annual Meeting. | |

| Q: |

May I revoke or change my vote after I have provided proxy instructions?

| |

| A: | Yes. You may revoke or change your vote at any time before your proxy is voted at the Annual Meeting. You can do this in one of three ways. First, you can send a written notice to the Company stating that you would like to revoke your proxy. Second, you can submit new proxy instructions either on a new proxy card, by telephone or over the Internet, as and if applicable. Third, you can attend the Annual Meeting and vote in person as described above. Please note that simply attending the Annual Meeting will not automatically revoke your proxy; you must vote during the Annual Meeting to override your prior instructions. If you have instructed a broker or other nominee to vote your shares, you must follow directions received from your broker or other nominee to change those instructions. | |

| Q: |

What constitutes a quorum?

| |

| A: |

Shareholders who hold a majority of the shares of Common Stock outstanding as of the close of business on the Record Date for the Annual Meeting must be present either in person or by proxy to constitute a quorum to conduct business at the Annual Meeting.

Once a quorum is present, such quorum is not broken by the subsequent withdrawal of any shareholder. If there is no quorum, the holders of a majority of shares present at the meeting in person or by proxy may adjourn the meeting to a different date. | |

| Q: |

Who is paying for this proxy solicitation?

| |

| A: | The Company will pay for the cost and expense of preparing, filing, assembling, printing and mailing this Proxy Statement, and any amendments thereto, the proxy card and any additional information furnished to the Company’s shareholders. The Company may also choose to reimburse brokers, custodians, nominees and fiduciaries for their costs of soliciting and obtaining proxies from beneficial owners, including the costs of reimbursing brokers, custodians, nominees and fiduciaries for their costs of forwarding this proxy statement and other solicitation materials to beneficial owners. In addition, proxies may be solicited without extra compensation by directors, officers and employees of the Company by mail, telephone, fax or other methods of communication. | |

| Q: |

Whom should I contact if I have any questions about the Proposals or the Annual Meeting?

| |

| A: | Shareholders may contact our Secretary, Dr. Desheng Wang, Focus Universal Inc., (626) 272-3883 at 2311 East Locust Court, Ontario, California 91761. | |

| 5 |

| Q: |

What information is available on the Internet?

| |

| A: |

A copy of this Proxy Statement and our annual report on Form 10-K, as amended, for the fiscal year ended December 31, 2024, are available for download online free of charge at www.proxyvote.com.

Our website address is www.focusuniversal.com. We use our website as a channel of distribution for important Company information. Important information, including press releases, analyst presentations and financial information regarding us is routinely posted and accessible on the Investors subpage of our website, which is accessible by clicking on the tab labeled “Investors” on our website home page. Visitors to our website can also register to receive automatic e-mail and other notifications alerting them when new information is made available on the Investors subpage of our website.

In addition, we make available on the Investors subpage of our website (under the link “SEC Filings”) free of charge our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, ownership reports on Forms 3 and 4 and any amendments to those reports, as soon as practicable after we electronically file such reports with the SEC. Further, copies of the charters for the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee of our Board of Directors are also available on the Investors subpage of our website under the link “Governance”. |

| 6 |

THE ANNUAL MEETING

General

The Company is furnishing this Proxy Statement to its shareholders in connection with the solicitation of proxies by the Board for use at the Annual Meeting of the Company’s shareholders with respect to the Election of Directors Proposal, Auditor Ratification Proposal, Common Stock Proposal, Preferred Stock Proposal, Say-on-Pay Proposal, and Say-on-Pay Frequency Proposal.

Date, Time, and Place

The Annual Meeting will be held on June 20, 2025, at 2:00 p.m., local time, at 2311 East Locust Court, Ontario, California 91761.

Purpose of the Annual Meeting

At the Annual Meeting, and any adjournments or postponements thereof, the Company’s shareholders will be asked to:

| · |

elect five (5) members to the Board to serve until the 2026 Annual Meeting of Shareholders;

| ||

| · |

ratify the selection of Weinberg & Company, P.A. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025;

| ||

| · |

to approve, subject to the Board of Director’s discretion to adopt, an amendment and restatement to our Articles of Incorporation to increase the number of authorized shares of our Common Stock from 15,000,000 shares to 25,000,000 shares;

| ||

| · |

to approve, subject to the Board of Director’s discretion to adopt, an amendment and restatement to our Articles of Incorporation to authorize 5,000,000 shares of Preferred Stock;

| ||

| · |

to approve, on a non-binding advisory basis, the compensation of our named executive officers; and

| ||

| · | to approve, on a non-binding advisory basis, the frequency of the shareholder advisory vote on the compensation of our named executive officers. |

THE MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING ARE OF GREAT IMPORTANCE TO THE COMPANY’S SHAREHOLDERS. ACCORDINGLY, SHAREHOLDERS ARE URGED TO READ AND CAREFULLY CONSIDER THE INFORMATION PRESENTED IN THIS PROXY STATEMENT.

| 7 |

Recommendation of the Board

The Board, by a unanimous vote, recommends that the shareholders of the Company vote:

| · |

“FOR” the “Election of Directors Proposal,” which is electing the five (5) nominees as members to the Board to serve until the 2026 Annual Meeting of Shareholders;

| ||

| · |

“FOR” the “Auditor Ratification Proposal,” which is a proposal to ratify the selection of Weinberg & Company, P.A. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025;

| ||

| · |

“FOR” the “Increase of Shares of Common Stock Proposal,” which is a proposal to approve an amendment to the Company’s Articles of Incorporation to increase the total number of authorized shares of our Common Stock from 15,000,000 shares to 25,000,000 shares;

| ||

| · |

“FOR” the “Approval to Authorize of Shares of Preferred Stock Proposal,” which is a proposal to approve an amendment to the Company’s Articles of Incorporation to authorize 5,000,000 shares of Preferred Stock;

| ||

| · |

“FOR” the “Say-on-Pay Proposal,” which is a proposal to approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers; and

| ||

| · | “FOR” the “Say-on-Pay Frequency Proposal,” which is a proposal to approve, on a non-binding advisory basis, the frequency of the shareholder advisory vote on the compensation of the Company’s named executive officers. |

Record Date; Shares Entitled to Vote

The Board has fixed April 21, 2025, as the Record Date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof. Only holders of record of shares of Common Stock at the close of business on the Record Date are entitled to receive notice of, attend, and vote at the Annual Meeting. A shareholder whose shares are held of record by a broker, bank or other nominee as of the Record Date, should check the voting instruction card forwarded by the shareholder’s broker, bank or other nominee in order to obtain directions on how to vote the shareholder’s shares, and such a shareholder must obtain a proxy issued in such shareholder’s name from that record holder in order to attend and vote at the Annual Meeting.

At the close of business on the Record Date, the Company had outstanding and entitled to vote [_____________] shares of Common Stock.

Holders of Common Stock are entitled to vote on all of the Proposals at the Annual Meeting. Each share of Common Stock outstanding on the Record Date entitles the holder thereof to one vote on each matter properly brought before the Annual Meeting, exercisable in person or by proxy. For each matter scheduled for a vote at the Annual Meeting, you may vote “For” or “Against” or you may “Abstain” from voting.

Quorum

To conduct the business described above at the Annual Meeting, the Company must have a quorum present. Shareholders who hold a majority of Common Stock outstanding as of the close of business on the Record Date for the Annual Meeting must be present either in person or by proxy to constitute a quorum to conduct business at the Annual Meeting.

Once a quorum is present, such quorum is not broken by the subsequent withdrawal of any shareholder. If there is no quorum, the holders of a majority of shares present at the meeting in person or by proxy may adjourn the meeting to a different date.

| 8 |

Required Vote

The Proposals being submitted for approval by the Company’s shareholders at the Annual Meeting will be approved or rejected on the basis of certain specific voting thresholds. In particular:

| · | Election of Directors Proposal: The election of the Board’s nominees to the Board at the 2025 Annual Meeting is expected to be an uncontested election. Our Bylaws (the “Bylaws”) require that directors be elected by a plurality of the votes cast at any meeting of shareholders. A plurality means that the candidate with the most votes for his or her election, even if less than a majority of those cast, is elected to the Board. Shareholders are not permitted to vote against a candidate. For purposes of determining whether a quorum is present, votes cast include votes to “withhold” and exclude abstentions with respect to that director’s election. Abstentions and broker non-votes will have no impact on this Proposal. |

| · | Auditor Ratification Proposal: This proposal will be ratified if votes cast represent a majority of the shares entitled to vote and represented at the meeting in person or by proxy vote in favor of the proposal. Therefore, abstentions and broker non-votes will have no impact on this Proposal. |

| · | Increase Shares of Common Stock Proposal: This proposal will be ratified if votes cast represent a majority of the shares entitled to vote and represented at the meeting in person or by proxy vote in favor of the proposal. Therefore, abstentions and broker non-votes will have no impact on this Proposal. |

| · | Authorize Shares of Preferred Stock Proposal: This proposal will be ratified if votes cast represent a majority of the shares entitled to vote and represented at the meeting in person or by proxy vote in favor of the proposal. Therefore, abstentions and broker non-votes will have no impact on this Proposal. |

| · | Say-on-Pay Proposal: The vote on this proposal is advisory, and therefore not binding on the Company, the Compensation Committee, or the Board. The vote will not be construed to create or imply any change to the fiduciary duties of the Company or the Board or create or imply any additional fiduciary duties for the Company or the Board. However, the Board and the Compensation Committee value input from our shareholders and will consider the outcome of the vote when making future executive compensation decisions. |

| · | Say-on-Pay Frequency Proposal: The vote on this proposal is advisory, and therefore not binding on the Company, the Compensation Committee, or the Board. The vote will not be construed to create or imply any change to the fiduciary duties of the Company or the Board or create or imply any additional fiduciary duties for the Company or the Board. However, the Board and the Compensation Committee value input from our shareholders and will consider the outcome of the vote when making future executive compensation decisions. |

Counting of Votes; Treatment of Abstentions and Incomplete Proxies; Broker Non-Votes

Shareholder of Record: Shares Registered in Your Name

The transfer agent for the Common Stock is VStock Transfer, LLC. If, as of the Record Date, your shares of Common Stock were registered directly in your name with the transfer agent, then you are a shareholder of record.

If you are a shareholder of record, you may vote in person at the Annual Meeting, vote by proxy by telephone, vote by proxy over the Internet, or vote by completing and returning the enclosed proxy card. Whether or not you plan to attend the Annual Meeting, the Company urges you to vote by proxy to ensure that your vote is counted. You may still attend the Annual Meeting and vote in person even if you have already voted by proxy.

| 9 |

Shareholders of record at the close of business on April 21, 2025, the Record Date for the Annual Meeting, may vote as follows:

| · | in person by coming to the Annual Meeting and completing a ballot that you will receive when you arrive; |

| · | through the Internet by visiting a website established for that purpose at www.proxyvote.com and following the instructions; |

| · | by telephone by calling the toll-free number 1-800-690-6903 in the United States, Puerto Rico or Canada on a touch-tone phone and following the recorded instructions; or |

| · | by returning the enclosed proxy card in the provided return envelope (which is postage paid if mailed in the United States). |

To vote via telephone or Internet, please have your proxy card in front of you. A phone number and an Internet website address is contained on your proxy card. Upon entering either the phone number or the Internet website address, you will be instructed on how to proceed.

If a shareholder does not submit a proxy card, provide proxy instructions by telephone or over the Internet or vote at the Annual Meeting, such shareholder’s shares will not be counted as present for the purpose of determining the presence of a quorum, which is required to transact business at the Annual Meeting, and will have no effect in the outcome of the Proposals.

If a shareholder signs, dates and mails a proxy card without indicating how such shareholder wishes to vote, such proxy card will be counted as present for the purpose of determining the presence of a quorum for the Annual Meeting and all of such shareholder’s shares will be voted “FOR” each Proposal. However, if a shareholder submits a proxy card or provides proxy instructions by telephone or over the Internet and affirmatively elects to abstain from voting, such proxy will be counted as present for the purpose of determining the presence of a quorum for the Annual Meeting and the abstention will have no effect in the outcome of the Proposals.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If, on the Record Date, your shares of Common Stock were held in an account at a broker, bank or other nominee, rather than in your name, then you are the beneficial owner of shares of Common Stock held in “street name” and a voting instruction card is being forwarded to you by that organization. The organization holding your account is considered to be the shareholder of record for purposes of voting at the Annual Meeting. Since you are not the shareholder of record, you may not vote your shares of Common Stock in person at the Annual Meeting unless you request and obtain a valid proxy from your broker or other agent.

Simply follow the voting instructions in the voting instruction card to ensure your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a proxy form.

If you do not give instructions to your broker, your broker can vote your shares of Common Stock with respect to “discretionary” items, but not with respect to “non-discretionary” items. Non-discretionary matters include director elections and other matters like those involving a matter that may substantially affect the rights or privileges of shareholders, such as mergers, acquisitions, share issuances or shareholder proposals. On non-discretionary items for which you do not give your broker instructions, the shares will be treated as broker non-votes.

If you do not instruct your broker or other nominee on how to vote your shares, then your broker or other nominee may vote your shares of Common Stock on the Proposals.

| 10 |

Counting Votes

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count “For,” “Against,” “Abstain” and broker non-votes.

Revoking Your Proxy

If you wish to change your vote with respect to any Proposal, you may do so by revoking your proxy at any time prior to the commencement of voting with respect to that Proposal at the Annual Meeting.

If you are the record holder of your shares, you can revoke your proxy by:

| · | sending a written notice stating that you would like to revoke your proxy to Dr. Desheng Wang, Secretary of the Company, at 2311 East Locust Court, Ontario, California 91761; |

| · | submitting new proxy instructions with a later date either on a new proxy card, by telephone or over the Internet, as and if applicable; or |

| · | attending the Annual Meeting and voting in person (but note that your attendance alone will not revoke your proxy). |

If you are a shareholder of record, revocation of your proxy or voting instructions by written notice must be received by 11:59 p.m., Pacific Time, on June 19, 2025, although you may also revoke your proxy by attending the Annual Meeting and voting in person. Simply attending the Annual Meeting will not, by itself, revoke your proxy. Your most current proxy card or telephone or Internet proxy is the one that will be counted. If your shares are held in street name by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank to revoke your proxy.

Solicitation of Proxies

The Company will pay for the cost and expense of preparing, filing, assembling, printing and mailing this Proxy Statement, any amendments thereto, the proxy card and any additional information furnished to the Company’s shareholders. The Company may also choose to reimburse brokerage houses and other custodians, nominees and fiduciaries for their costs of soliciting and obtaining proxies from beneficial owners, including the costs of reimbursing brokerage houses and other custodians, nominees and fiduciaries for their costs of forwarding this proxy statement and other solicitation materials to beneficial owners. In addition, proxies may be solicited without extra compensation by directors, officers and employees of the Company by mail, telephone, email, fax or other methods of communication.

Delivery of Proxy Materials to Households Where Two or More Shareholders Reside

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements with respect to two or more shareholders sharing the same address by delivering a single proxy statement addressed to those shareholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for shareholders and cost-savings for companies.

In connection with the Annual Meeting, a number of brokers with account holders who are the Company’s shareholders will be householding the proxy materials. As a result, a single proxy statement will be delivered to multiple shareholders sharing an address unless contrary instructions have been received from the applicable shareholders. Once a shareholder receives notice from its broker that they will be householding communications to such shareholder’s address, householding will continue until such shareholder is notified otherwise or until such shareholder revokes its consent. If, at any time, a shareholder no longer wishes to participate in householding and would prefer to receive a separate proxy statement, such shareholder should notify its broker or contact the Company at (626) 272-3883. Shareholders who currently receive multiple copies of this proxy statement at their address and would like to request householding of their communications should contact their broker.

| 11 |

Attending the Annual Meeting

Attendance at the Annual Meeting is limited to shareholders of the Company as of the Record Date. For safety and security reasons, video and audio recording devices and other electronic devices will not be allowed in the meeting. If your shares are held in the name of your bank, brokerage firm or other nominee, you must bring to the Annual Meeting a copy of your proxy card, an account statement, or a letter from the nominee indicating that you beneficially owned the shares as of the Record Date for voting. If you do not have proof of share ownership, you will not be admitted to the Annual Meeting.

For registered shareholders, a copy of your proxy card can serve as verification of stock ownership. Shareholders who do not present a copy of their proxy card at the Annual Meeting will be admitted only upon verification of stock ownership, as indicated herein. If you do not have proof of share ownership, you will not be admitted to the Annual Meeting. In addition, all Annual Meeting attendees will be asked to present valid government-issued photo identification, such as a driver’s license or passport, as proof of identification before entering the Annual Meeting, and attendees may be subject to security inspections.

Dissenters’ Rights

Under Nevada law, holders of the Common Stock will not be entitled to appraisal, dissenters’ or similar rights in connection with any of the Proposals to be considered at the Annual Meeting.

| 12 |

PROPOSAL ONE

ELECTION OF DIRECTORS

The nominees listed below have been selected by the Nominating and Corporate Governance Committee of the Board is charged with making recommendations to the Board regarding qualified candidates to serve as members of the Board. The Nominating and Corporate Governance Committee’s goal is to assemble a board of directors with the skills and characteristics that, taken as a whole, will assure a Board with experience and expertise in all aspects of corporate governance.

The nominees all are currently members of the Board. If elected, each nominee will serve until the annual meeting of shareholders to be held in 2026 (or action by written consent of shareholders in lieu thereof), or until his or her successor has been duly elected and qualified.

Composition of Board of Directors

Our Bylaws provide that the Board shall consist of not less than one (1) and not more than nine (9) directors. The Board currently consists of five (5) members. The Board has fixed the size of the Board to be elected in 2025 at five (5) members.

In the event that a nominee is unable or declines to serve as a director at the time of the Annual Meeting, the Board’s Nominating and Corporate Governance Committee would identify and make recommendations to the Board regarding the selection and approval of candidates to fill such vacancy either by election by shareholders or appointment by the Board. As of the date of this Proxy Statement, the Board is not aware of any nominee who is unable or will decline to serve as a director. With respect to the nominees for election in 2025, the Nominating and Corporate Governance Committee recommended that the Board nominate for election by the shareholders the individuals named in this Proposal One.

Nominees for Election as Directors

The Nominating Committee has recommended, and the Board has nominated, Dr. Desheng Wang, Dr. Edward Lee, Michael Pope, Carine Clark, and Sean Warren as nominees for election as members of our Board at the Annual Meeting for a period of one (1) year or until such director’s respective successor is elected and qualified or until such director’s earlier death, resignation, or removal. Each of the nominees is currently a director of the Company. At the Annual Meeting, five (5) directors will be elected to the Board. The following table sets for the nominees for directors on the Board. Certain biographical information about the nominees as of the Record Date below.

| Name | Position with the Company | Age | Director Since | |||

| Dr. Desheng Wang | Chief Executive Officer, Secretary, and Director | 61 | December 29, 2014 | |||

| Dr. Edward Lee | Director and Chairman | 60 | October 21, 2015 | |||

| Michael Pope | Independent Director(1)(2)(3)(4) | 44 | June 8, 2018 | |||

| Carine Clark | Independent Director(1)(2)(3)(5) | 61 | June 8, 2018 | |||

| Sean Warren | Independent Director(1)(2)(3)(6) | 53 | August 10, 2022 |

_____________

| (1) | Member of Audit Committee. |

| (2) | Member of Compensation Committee. |

| (3) | Member of Nominating and Corporate Governance Committee. |

| (4) | Chairperson of Audit Committee. |

| (5) | Chairperson of Compensation Committee. |

| (6) | Chairperson of Nominating and Corporate Governance Committee. |

| 13 |

The following chart provides certain self-identified characteristics of our nominees and current directors utilizing the categories and terms set forth in the applicable Nasdaq rules and related guidance.

|

Board of Directors Diversity Matrix (as of April 18, 2025) |

||||

| Total Director Nominees and Continuing Directors | 5 | |||

| Female | Male | Non-Binary | Did Not Disclose Gender | |

| Gender Identity | ||||

| Directors | 1 | 4 | – | – |

| Demographic Background | ||||

| African American or Black | – | – | ||

| Alaskan Native or Native American | – | – | ||

| Asian | – | 2 | ||

| Hispanic, Latinx or Spanish Origin | – | – | ||

| Native Hawaiian or Pacific Islander | – | – | ||

| White | 1 | 2 | ||

| Other | – | – | ||

| Two or More Races of Ethnicities | – | – | ||

| LGBTQ+ | – | – | ||

| Did not Disclose Demographic Background | – | – | ||

Vote Required and Recommendation of the Board

Directors are elected by a plurality of the votes cast at the Annual Meeting. If a quorum is present, the nominees receiving the highest number of “FOR” votes will be elected to the Board. Shares represented by executed proxies will be voted for which no contrary instruction is given, if authority to do so is not withheld, “FOR” the election of each of the nominees named above. Only votes “FOR” will affect the outcome. Abstentions and broker non-votes will have no effect on the election of directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE ELECTION OF DR. DESHENG WANG, DR. EDWARD LEE, MICHAEL POPE, CARINE CLARK, AND SEAN WARREN TO THE BOARD OF DIRECTORS.

| 14 |

Biographical Information Regarding Directors and Nominees

Dr. Desheng Wang was appointed as Chief Executive Officer, Secretary, and has been a director of the Company since December 29, 2014. Dr. Wang has over 20 years of professional experience in mobile technology. Dr. Wang earned his bachelor’s degree from Hebei Normal University, Physics Department in 1985. In 1988, Dr. Wang earned his master’s degree from Dalian Institute of Chemical Physics at the Chinese Academy of Science. Dr. Wang earned his Ph.D. in Chemistry at Emory University in 1994. Dr. Wang served as a senior research fellow at California Institute of Technology from 1994-2011. Over the last five years, Dr. Wang has served as president of Vitashower Corporation and, formerly, as President of Perfecular Inc.

Dr. Edward Lee was appointed President and director of the Company on October 21, 2015. On November 15, 2019, Dr. Lee resigned as President and was appointed as Chairman of the Board. Dr. Lee received his bachelor’s degree in mathematics at Lanzhou University in 1983, received his master’s degree at University of Science and Technology of China in 1985 and earned his Ph.D. in Mathematics at University of Florida in 1991. Dr. Lee worked as an assistant professor at Tsinghua University in 1986 and National University of Singapore in 1992. Since 1996, Dr. Lee has served as CEO of AIDP, a leading supplier of dietary supplement ingredients, focusing on research and development and marketing and sales of proprietary ingredients like Magtein, KoACT, Predtic X, and Actizin. Dr. Lee is also serving as the Vice Chairperson of the American Chinese CEO Association.

Michael Pope was appointed as an independent director of the Company on June 8, 2018. Mr. Pope serves as the CEO and Chairman at Boxlight Corporation (Nasdaq: BOXL), a global provider of interactive technology solutions, where he has been an executive since July 2015 and director since September 2014. Mr. Pope has led Boxlight through eleven acquisitions from 2016 to 2021, a Nasdaq IPO in November 2017, and over $200 million in debt and equity fundraising. He previously served as Managing Director at Vert Capital, a private equity and advisory firm from October 2011 to October 2016, managing portfolio holdings in the education, consumer products, technology and digital media sectors. Prior to joining Vert Capital, from May 2008 to October 2011, Mr. Pope was Chief Financial Officer and Chief Operating Officer for the Taylor Family in Salt Lake City, managing family investment holdings in consumer products, professional services, real estate and education. Mr. Pope also held positions including senior SEC reporting at Omniture (previously listed on Nasdaq and acquired by Adobe (Nasdaq: ADBE in 2009) and Assurance Associate at Grant Thornton. Since January 2021, Mr. Pope has served as a member of the board of directors of Novo Integrated Sciences, Inc. (OTCQB: NVOS), a provider of multi-dimensional primary healthcare products and services. He holds an active CPA license and earned his undergraduate and graduate degrees in accounting from Brigham Young University.

Carine Clark was appointed as an independent director of the Company on June 8, 2018. Ms. Clark has served as president and CEO of four high-growth tech companies. In March 2019, Ms. Clark was appointed to the board of directors of Domo, Inc. (NASDAQGM: DOMO) and is currently serving as a member of Domo’s compensation committee. Since 2017 she has served as an Executive Board Member of the Utah Governor’s Office of Economic Development and Silicon Slopes, a non-profit helping Utah’s tech community thrive. Prior to that, Ms. Clark served from January 2015 to December 2016 as the President and CEO of MartizCX. From December 2012 to December 2016, Ms. Clark served as the President and CEO of Allegiance, Inc. She has built a reputation as a data-driven marketing executive working at Novell for 14 years, Altiris for five years, and Symantec for more than 10 years. She has received numerous awards including the EY Entrepreneur of The Year® Award in the Utah Region and Utah Business Magazine’s CEO of the Year. Ms. Clark earned a bachelor’s degree in organizational communications and an MBA from Brigham Young University.

Sean Warren was appointed as an independent director of the Company on August 10, 2022. Mr. Warren is a seasoned executive with over 25 years of experience in technology and enterprise technology systems. He brings a wealth of expertise with strengths in areas such as software development, cloud management, enterprise infrastructure development and full spectrum of IT compliance. Mr. Warren has been the CIO of Mountain Medical, Veyo Medical and VP of IT at Larry Miller. He has worked for technology companies such as Omniture, Adobe and served as the director of cloud operations at Domo from 2016 to 2018. From 2019-2021, Mr. Warren served as the VP of OPSA Change Advisory at Wells Fargo, and since 2021 to the present works as the VP of Global Platform Services at Cotiviti where he manages over 1,000 employees globally in four countries. Mr. Warren is fluent in Spanish and graduated from Florida State University in accounting. Mr. Warren previously served on our Board from June 8, 2018 to November 28, 2018.

| 15 |

Other Executive Officers of the Company

The following is certain information as of the Record Date regarding the other executive officers of the Company not discussed above.

| Name | Position with the Company | Age | Officer Since | |||

| Irving Kau | Chief Financial Officer | 50 | November 18, 2022 |

Irving Kau was appointed as Chief Financial Officer of the Company on November 18, 2022. Prior to that, he served as Focus Universal’s Vice President of Finance and Head of Investor Relations since November 10, 2021. Prior to joining the Company, Mr. Kau served as a Managing Partner of both Elementz Ventures and KW Capital Partners, and during his tenure he successfully invested in and grew companies across various geographies. The Company expects that as Chief Financial Officer, Mr. Kau will assist with many matters in the near future, including building up the Company’s internal businesses, processes and controls, the Company’s external outreach and growth measures, as well as strengthen the Company’s financial reporting and the investor relations. Prior to his work at Elementz Ventures and KW Capital Partners, Mr. Kau served as the head of Asia at GHS (now known as Seaport Global). Mr. Kau also previously served for approximately 10 years as Chief Financial Officer of an AgBiotech company Origin Agritech Limited (Nasdaq: SEED). During his tenure, shareholders included Wellington Management, Fidelity Investments, Citadel Investments, Heartland Fund, Mitsubishi UFJ, amongst others. Mr. Kau received undergraduate degrees from Johns Hopkins University and a graduate degree from Rice University and pursued a PhD degree in Business Strategy (economics) at the University of Southern California.

| 16 |

CORPORATE GOVERNANCE

Board of Directors

Our Board currently consists of five (5) members. Our Chairperson of the Board is Dr. Edward Lee. Dr. Edward Lee and Dr. Desheng Wang are the two (2) members of our Board who are not independent directors. Michael Pope, Sean Warren, and Carine Clark are the three (3) members of our Board who are independent directors.

Director Attendance at Meetings

Our Board conducts its business through meetings, both in person and telephonic, and by actions taken by written consent in lieu of meetings. During the year ended December 31, 2024, our Board held four (4) meetings. All directors attended at least 75% of the meetings of our Board and of the committees of our Board on which they served during 2024.

Our Board encourages all directors to attend our annual meetings of shareholders unless it is not reasonably practicable for a director to do so.

Committees of our Board of Directors

Our Board has established and delegated certain responsibilities to its standing Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Our corporate website, www.focusuniversal.com, contains the charters for our Audit, Compensation, and Nominating and Corporate Governance Committees, and certain other corporate governance documents and policies. In addition, we will provide a copy of any of these documents without charge to any shareholder upon written request made in care of the Corporate Secretary, Focus Universal Inc., 2311 East Locust Court, Ontario, California 91761. The information at www.focusuniversal.com is not, and shall not be deemed to be, a part of this Proxy Statement or incorporated by reference into this or any other filing we make with the SEC.

Audit Committee

We have a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee’s primary duties and responsibilities include monitoring the integrity of our financial statements, monitoring the independence and performance of our external auditors, and monitoring our compliance with applicable legal and regulatory requirements. The functions of the Audit Committee also include reviewing periodically with our independent registered public accounting firm the performance of the services for which they are engaged, including reviewing the scope of the annual audit and its results, reviewing with management and the auditors the adequacy of our internal accounting controls, reviewing with management and the auditors the financial results prior to the filing of quarterly and annual reports, reviewing fees charged by our independent registered public accounting firm and reviewing any transactions between our Company and related parties. Our independent registered public accounting firm reports directly and is accountable solely to the Audit Committee. The Audit Committee has the sole authority to hire and fire the independent registered public accounting firm and is responsible for the oversight of the performance of their duties, including ensuring the independence of the independent registered public accounting firm. The Audit Committee also approves in advance the retention of, and all fees to be paid to, the independent registered public accounting firm. The rendering of any auditing services and all non-auditing services by the independent registered public accounting firm is subject to prior approval of the Audit Committee.

The Audit Committee operates under a written charter. The Audit Committee is required to be composed of directors who are independent under the rules of the SEC and the listing standards of The Nasdaq Stock Market LLC (“NASDAQ”).

The current members of the Audit Committee are directors Mr. Michael Pope, the Chairperson of the Audit Committee, Ms. Carine Clark, and Mr. Sean Warren, all of whom have been determined by the Board to be independent under the NASDAQ listing standards and rules adopted by the SEC applicable to audit committee members. The Board has determined that Mr. Michael Pope qualifies as an “audit committee financial expert” under the rules adopted by the SEC and the Sarbanes-Oxley Act. The Audit Committee met four (4) times during 2024.

| 17 |

Compensation Committee

The primary duties and responsibilities of our standing Compensation Committee are to review, modify and approve the overall compensation policies for the Company, including the compensation of the Company’s Chief Executive Officer and other senior management; establish and assess the adequacy of director compensation; and approve the adoption, amendment and termination of the Company’s stock option plans, pension and profit-sharing plans, bonus plans and similar programs. The Compensation Committee may delegate to one or more officers the authority to make grants of options and restricted stock to eligible individuals other than officers and directors, subject to certain limitations. Additionally, the Compensation Committee has the authority to form subcommittees and to delegate authority to any such subcommittee. The Compensation Committee also has the authority, in its sole discretion, to select, retain and obtain, at the expense of the Company, advice and assistance from internal or external legal, accounting or other advisors and consultants. Moreover, the Compensation Committee has sole authority to retain and terminate any compensation consultant to assist in the evaluation of director, Chief Executive Officer or senior executive compensation, including sole authority to approve such consultant’s reasonable fees and other retention terms, all at the Company’s expense.

The Compensation Committee operates under a written charter. All members of the Compensation Committee must satisfy the independence requirements of NASDAQ applicable to compensation committee members.

The Compensation Committee currently consists of directors Ms. Carine Clark, Mr. Sean Warren, and Mr. Michael Pope. Ms. Carine Clark is the Chairperson of the Compensation Committee. Each of the Compensation Committee members has been determined by the Board to be independent under NASDAQ listing standards applicable to compensation committee members. The Compensation Committee met four (4) times during 2024.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee identifies, reviews and evaluates candidates to serve on the Board; reviews and assesses the performance of the Board and the committees of the Board; and assesses the independence of our directors. The Nominating and Corporate Governance Committee is also responsible for reviewing the composition of the Board’s committees and making recommendations to the entire Board regarding the chairpersonship and membership of each committee. In addition, the Nominating and Corporate Governance Committee is responsible for developing corporate governance principles and periodically reviewing and assessing such principles, as well as periodically reviewing the Company’s policy statements to determine their adherence to the Company’s Code of Business Conduct and Ethics.

The Nominating and Corporate Governance Committee has adopted a charter that identifies the procedures whereby Board candidates are identified primarily through suggestions made by directors, management and shareholders of the Company. We have implemented no material changes in the past year to the procedures by which shareholders may recommend nominees for the Board. The Nominating and Corporate Governance Committee will consider director nominees recommended by shareholders that are submitted in writing to the Company’s Corporate Secretary in a timely manner and which provide necessary biographical and business experience information regarding the nominee. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the criteria considered by the Nominating and Corporate Governance Committee, based on whether or not the candidate was recommended by a shareholder. The Board does not prescribe any minimum qualifications for director candidates, and all candidates for director will be evaluated based on their qualifications, diversity, age, skill and such other factors as deemed appropriate by the Nominating and Corporate Governance Committee given the current needs of the Board, the committees of the Board and the Company. Although the Nominating and Corporate Governance Committee does not have a specific policy on diversity, it considers the criteria noted above in selecting nominees for directors, including members from diverse backgrounds who combine a broad spectrum of experience and expertise. Absent other factors which may be material to its evaluation of a candidate, the Nominating and Corporate Governance Committee expects to recommend to the Board for selection incumbent directors who express an interest in continuing to serve on the Board. Following its evaluation of a proposed director’s candidacy, the Nominating and Corporate Governance Committee will make a recommendation as to whether the Board should nominate the proposed director candidate for election by the shareholders of the Company.

| 18 |

The Nominating and Corporate Governance Committee operates under a written charter. No member of the Nominating and Corporate Governance Committee may be an employee of the Company, and each member must satisfy the independence requirements of NASDAQ and the SEC.

The Nominating and Corporate Governance Committee currently consists of directors Mr. Sean Warren, who is the Chairperson of the committee, Mr. Michael Pope and Ms. Carine Clark. Each of the members of the Nominating and Corporate Governance Committee has been determined by the Board to be independent under NASDAQ listing standards. The Nominating and Corporate Governance Committee met four (4) times in 2024.

Communications with our Board of Directors

In order to provide the Company’s security holders and other interested parties with a direct and open line of communication to the Board, the Board has adopted the following procedures for communications to directors. The Company’s security holders and other interested persons may communicate with the Chairperson of the Company’s Audit Committee or with the non-management directors of the Company as a group by mailing a letter addressed in care of the Corporate Secretary to Focus Universal Inc., 2311 East Locust Court, Ontario, California 91761.

All communications received in accordance with these procedures will be reviewed initially by the Company’s Secretary and/or other executive officers. The Company will relay all such communications to the appropriate director or directors unless the Secretary determines that the communication:

| · | does not relate to the business or affairs of the Company or the functioning or constitution of the Board or any of its committees; |

| · | relates to routine or insignificant matters that do not warrant the attention of the Board; |

| · | is an advertisement or other commercial solicitation or communication; |

| · | is frivolous or offensive; or |

| · | is otherwise not appropriate for delivery to directors. |

The director or directors who receive any such communication will have discretion to determine whether the subject matter of the communication should be brought to the attention of the full Board or one or more of its committees, and whether any response to the person sending the communication is appropriate. Any such response will be made only in accordance with applicable law and regulations relating to the disclosure of information.

The Secretary will retain copies of all communications received pursuant to these procedures for a period of at least one (1) year. The Nominating and Corporate Governance Committee of the Board will review the effectiveness of these procedures from time to time and, if appropriate, recommend changes.

Oversight of Risk Management

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including economic risks, financial risks, legal and regulatory risks and others, such as the impact of competition. Management is responsible for the day-to-day management of the risks that we face, while our Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board is responsible for satisfying itself that the risk management processes designed and implemented by management are adequate and functioning as designed. Our Board assesses major risks facing our Company and options for their mitigation in order to promote our shareholders’ interests, the long-term health of our Company and our overall success and financial strength. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for us. The involvement of our full Board in the risk oversight process allows our Board to assess management’s appetite for risk and also determine what constitutes an appropriate level of risk for our Company. Our Board regularly includes agenda items at its meetings relating to its risk oversight role and meets with various members of management on a range of topics, including corporate governance and regulatory obligations, operations and significant transactions, risk management, insurance, pending and threatened litigation and significant commercial disputes.

| 19 |

While our Board is ultimately responsible for risk oversight, various committees of our Board oversee risk management in their respective areas and regularly report on their activities to our entire Board. In particular, the Audit Committee has the primary responsibility for the oversight of financial risks facing our Company. The Audit Committee’s charter provides that it will discuss our major financial risk exposures and the steps we have taken to monitor and control such exposures. Our Board has also delegated primary responsibility for the oversight of all executive compensation and our employee benefit programs to the Compensation Committee. The Compensation Committee strives to create incentives that encourage a level of risk-taking behavior consistent with our business strategy.

We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing our Company and that our Board’s leadership structure provides appropriate checks and balances against undue risk taking.

Code of Business Conduct and Ethics

Our Board has adopted a code of ethical conduct that applies to our principal executive officer, principal financial officer and senior financial management. This code of ethical conduct is embodied within our Code of Business Conduct and Ethics, which applies to all persons associated with our Company, including our directors, officers and employees (including our principal executive officer, principal financial officer, and controller). In order to satisfy our disclosure requirements under Item 5.05 of Form 8-K, we will disclose amendments to, or waivers of, certain provisions of our Code of Business Conduct and Ethics relating to our chief executive officer, chief financial officer, chief accounting officer, controller or persons performing similar functions on our corporate website, www.focusuniversal.com, promptly following the adoption of any such amendment or waiver. The Code of Business Conduct and Ethics provides that any waivers of, or changes to, the code that apply to the Company’s executive officers or directors may be made only by the Audit Committee. In addition, the Code of Business Conduct and Ethics includes updated procedures for non-executive officer employees to seek waivers of the code.

Insider Trading Policy

The Company has an Insider Trading Policy governing the purchase, sale and other dispositions of the Company’s securities that applies to all personnel of the Company and its subsidiaries, including directors, officers and employees and other covered persons. We believe that our Insider Trading Policy is reasonably designed to promote compliance with insider trading laws, rules and regulations, as well as applicable listing standards. It is also the policy of the Company to comply with all applicable securities laws when transacting in its own securities.

Director Independence

Our Company is governed by our Board. Currently, each member of our Board, other than Dr. Edward Lee and Dr. Desheng Wang, is an independent director; and all standing committees of our Board are composed entirely of independent directors, in each case under NASDAQ’s independence definition applicable to boards of directors. For a director to be considered independent, our Board must determine that the director has no relationship which, in the opinion of our Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Members of the Audit Committee also must satisfy a separate SEC independence requirement, which provides that they may not accept directly or indirectly any consulting, advisory or other compensatory fee from us or any of our subsidiaries other than their directors’ compensation. In addition, under SEC rules, an Audit Committee member who is an affiliate of the issuer (other than through service as a director) cannot be deemed to be independent. In determining the independence of members of the Compensation Committee, NASDAQ listing standards require our Board to consider certain factors, including, but not limited to: (1) the source of compensation of the director, including any consulting, advisory or other compensatory fee paid by us to the director, and (2) whether the director is affiliated with us, one of our subsidiaries or an affiliate of one of our subsidiaries. Under our Compensation Committee Charter, members of the Compensation Committee also must qualify as “outside directors” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and as “non-employee directors” for purposes of Rule 16b-3 under the Exchange Act. For purposes of clarity, the independent members of the Board are Mr. Michael Pope, Ms. Carine Clark, and Mr. Sean Warren.

| 20 |

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (“CD&A”) describes the compensation of our Chief Executive Officer (“CEO”) and together with our other Named Executive Officers (“NEOs”). Our NEOs for 2024 were:

| · | Dr. Desheng Wang, Chief Executive Officer and Secretary |

| · | Irving Kau, Chief Financial Officer |

Compensation Program and Philosophy

The Compensation Committee administers the Company’s executive compensation program. The Compensation Committee has the authority to review and determine the salaries and bonuses of the executive officers of the Company, including the Chief Executive Officer and the other named executive officers, and to establish the overall compensation policies for the Company. The Compensation Committee also has the authority to make discretionary option grants to all of the Company’s employees under the Company’s equity incentive plans.

The Compensation Committee operates under a written charter. The duties and responsibilities of a member of the Compensation Committee are in addition to his or her duties as a member of the Board. The charter reflects these various responsibilities, and the Compensation Committee is charged with periodically reviewing the charter. The Compensation Committee’s membership is determined by the Board and is composed entirely of independent directors. In addition, the Compensation Committee has the authority to engage the services of outside advisors, experts and others, including independent compensation consultants who do not advise the Company, to assist the Compensation Committee. The Compensation Committee currently consists of directors Ms. Carine Clark, Mr. Sean Warren, and Mr. Michael Pope. Ms. Carine Clark is the Chairperson of the Compensation Committee. Each of the Compensation Committee members has been determined by the Board to be independent under NASDAQ listing standards applicable to compensation committee members. The Compensation Committee met four (4) times during 2024.