SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Quarterly period ended March 31, 2021

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission File No. 000-55247

FOCUS UNIVERSAL INC.

(Exact Name of Small Business Issuer as specified in its charter)

| Nevada | 46-3355876 |

| (State or other jurisdiction | (IRS Employer File Number) |

| of incorporation) |

| 20511 E. Locust St., Ontario, CA | 91761 |

| (Address of principal executive offices) | (zip code) |

(626) 272-3883

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| N/A | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant: (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit such files. Yes o No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o | Smaller reporting company x |

| Emerging growth company x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes o No x

As of May 10, 2021, registrant had 40,959,741 shares outstanding of the registrant's common stock at a par value of $0.001 per share.

FORM 10-Q

FOCUS UNIVERSAL INC.

| 2 |

PART I. FINANCIAL INFORMATION

References in this document to "us," "we," or "Company" refer to Focus Universal Inc.

FOCUS UNIVERSAL INC.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

Index to the Financial Statements

| 3 |

FOCUS UNIVERSAL INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| March 31, | December 31, | |||||||

| 2021 | 2020 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 1,908,247 | $ | 583,325 | ||||

| Accounts receivable, net | 347,924 | 190,556 | ||||||

| Inventories, net | 24,808 | 42,496 | ||||||

| Prepaid expenses | 37,913 | 91,253 | ||||||

| Deposit - current portion | – | 100,000 | ||||||

| Total Current Assets | 2,318,892 | 1,007,630 | ||||||

| Property and equipment, net | 4,451,973 | 4,492,510 | ||||||

| Operating lease right-of-use asset | 75,016 | 86,558 | ||||||

| Deposits | 6,630 | 6,630 | ||||||

| Total Assets | $ | 6,852,511 | $ | 5,593,328 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable and accrued liabilities | $ | 341,334 | $ | 198,870 | ||||

| Accounts payable - related party | – | 17,471 | ||||||

| Other current liabilities | 6,332 | 6,332 | ||||||

| Customer deposit | 3,927 | 57,377 | ||||||

| Loan, current portion | 355,021 | 194,125 | ||||||

| Lease liability, current portion | 55,890 | 53,384 | ||||||

| Total Current Liabilities | 762,504 | 527,559 | ||||||

| Non-Current Liabilities: | ||||||||

| Lease liability, less current portion | 26,402 | 41,287 | ||||||

| Loan, less current portion | 1,805,536 | 202,735 | ||||||

| Other liability | 17,135 | 17,135 | ||||||

| Total Non-Current Liabilities | 1,849,073 | 261,157 | ||||||

| Total Liabilities | 2,611,577 | 788,716 | ||||||

| Contingencies (Note 13) | – | – | ||||||

| Stockholders' Equity: | ||||||||

| Common stock, par value $0.001 per share, 75,000,000 shares authorized; 40,959,741 shares issued and outstanding as of March 31, 2021 and December 31, 2020, respectively | 40,959 | 40,959 | ||||||

| Additional paid-in capital | 14,487,896 | 14,381,058 | ||||||

| Shares to be issued, common shares | 110,709 | 98,709 | ||||||

| Accumulated deficit | (10,398,630 | ) | (9,716,114 | ) | ||||

| Total Stockholders' Equity | 4,240,934 | 4,804,612 | ||||||

| Total Liabilities and Stockholders' Equity | $ | 6,852,511 | $ | 5,593,328 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

| F-1 |

FOCUS UNIVERSAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

| Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Revenue | $ | 353,272 | $ | 295,937 | ||||

| Revenue - related party | 10,191 | 14,672 | ||||||

| Total Revenue | 363,463 | 310,609 | ||||||

| Cost of Revenue | 292,263 | 338,072 | ||||||

| Gross Profit (Loss) | 71,200 | (27,463 | ) | |||||

| Operating Expenses: | ||||||||

| Selling expense | 512 | 15,070 | ||||||

| Compensation - officers | 39,100 | 34,000 | ||||||

| Research and development | 63,150 | 70,396 | ||||||

| Professional fees | 377,547 | 433,539 | ||||||

| General and administrative | 310,084 | 389,813 | ||||||

| Total Operating Expenses | 790,393 | 942,818 | ||||||

| Loss from Operations | (719,193 | ) | (970,281 | ) | ||||

| Other Income (Expense): | ||||||||

| Interest income (expense), net | (7,533 | ) | 1,275 | |||||

| Interest (expense) - related party | – | (81 | ) | |||||

| Other income | 44,210 | 46,781 | ||||||

| Total other income (expense) | 36,677 | 47,975 | ||||||

| Loss before income taxes | (682,516 | ) | (922,306 | ) | ||||

| Income tax expense | – | – | ||||||

| Net Loss | $ | (682,516 | ) | $ | (922,306 | ) | ||

| Weight Average Number of Common Shares Outstanding: Basic and Diluted | 40,959,741 | 40,959,741 | ||||||

| Net Loss per common share: Basic and Diluted | $ | (0.02 | ) | $ | (0.02 | ) | ||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

| F-2 |

FOCUS UNIVERSAL INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

| Common stock | Additional Paid-In | Shares to be issued Common | Accumulated | Total Stockholders' | ||||||||||||||||||||

| Description | Shares | Amount | Capital | Shares | Deficit | Equity | ||||||||||||||||||

| Balance - December 31, 2020 | 40,959,741 | $ | 40,959 | $ | 14,381,058 | $ | 98,709 | $ | (9,716,114 | ) | $ | 4,804,612 | ||||||||||||

| Stock based compensation - options | – | – | 106,838 | – | – | 106,838 | ||||||||||||||||||

| Common stock to be issued for services | – | – | – | 12,000 | – | 12,000 | ||||||||||||||||||

| Net loss | – | – | – | – | (682,516 | ) | (682,516 | ) | ||||||||||||||||

| Balance - March 31, 2021 | 40,959,741 | 40,959 | 14,487,896 | 110,709 | (10,398,630 | ) | 4,240,934 | |||||||||||||||||

| Common stock | Additional Paid-In | Shares to be issued | Accumulated | Total Stockholders' | ||||||||||||||||||||

| Description | Shares | Amount | Capital | Common Shares | Deficit | Equity | ||||||||||||||||||

| Balance - December 31, 2019 | 40,959,741 | $ | 40,959 | $ | 13,775,908 | $ | 50,709 | $ | (7,179,001 | ) | $ | 6,688,575 | ||||||||||||

| Stock based compensation - options | – | – | 259,350 | – | – | 259,350 | ||||||||||||||||||

| Common stock to be issued for services | – | – | – | 12,000 | – | 12,000 | ||||||||||||||||||

| Net loss | – | – | – | – | (922,306 | ) | (922,306 | ) | ||||||||||||||||

| Balance - March 31, 2020 | 40,959,741 | 40,959 | 14,035,258 | 62,709 | (8,101,307 | ) | 6,037,619 | |||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

| F-3 |

FOCUS UNIVERSAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

| Three Months Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Cash flows from operating activities: | ||||||||

| Net Loss | $ | (682,516 | ) | $ | (922,306 | ) | ||

| Adjustments to reconcile net loss to net cash from operating activities: | ||||||||

| Bad debt expense | 8,357 | – | ||||||

| Inventories reserve | (3,287 | ) | 189 | |||||

| Depreciation expense | 40,537 | 40,598 | ||||||

| Amortization of right-of-use assets | (837 | ) | (378 | ) | ||||

| Stock-based compensation | 12,000 | 12,000 | ||||||

| Stock option compensation - options | 106,838 | 259,350 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (165,725 | ) | (94,161 | ) | ||||

| Accounts receivable - related party | – | (23,977 | ) | |||||

| Inventories | 20,975 | (14,437 | ) | |||||

| Prepaid expenses | 53,340 | 6,634 | ||||||

| Deposit | 100,000 | – | ||||||

| Accounts payable and accrued liabilities | 142,464 | 123,969 | ||||||

| Accounts payable - related party | (17,471 | ) | – | |||||

| Other current liabilities | – | (12,334 | ) | |||||

| Interest payable - related party | – | (1,750 | ) | |||||

| Customer deposit | (53,450 | ) | (22,984 | ) | ||||

| Net cash flows used in operating activities | (438,775 | ) | (649,587 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from SBA loan | 267,297 | – | ||||||

| Payment on promissory note | – | (50,000 | ) | |||||

| Proceeds from bank loan | 1,500,000 | – | ||||||

| Prepayment on bank loan | (3,600 | ) | – | |||||

| Net cash flows provided by (used in) financing activities | 1,763,697 | (50,000 | ) | |||||

| Net change in cash | 1,324,922 | (699,587 | ) | |||||

| Cash beginning of period | 583,325 | 2,192,870 | ||||||

| Cash end of period | $ | 1,908,247 | $ | 1,493,283 | ||||

| Supplemental cash flow disclosure: | ||||||||

| Cash paid for income taxes | $ | – | $ | – | ||||

| Cash paid for interest | $ | 5,437 | $ | 1,831 | ||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements

| F-4 |

FOCUS UNIVERSAL INC.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Note 1 – Organization and Operations

Focus Universal Inc. (“Focus”) was incorporated under the laws of the state of Nevada on December 4, 2012 (“Inception”). It is a universal smart instrument developer and manufacturer, headquartered in the Los Angeles, California metropolitan area, specializing in the research and development and commercialization of novel and proprietary universal smart technologies and instruments related to the internet of things (“IoT”) and telecommunications industries. Focus is researching and developing novel and proprietary ultra-narrowband powerline communication (“PLC”) technology that allows users to send data over existing electricity power cables without the noise problems that have plagued PLC for decades. Universal smart technology is an off-the-shelf technology utilizing an innovative hardware integrated platform. The Focus platform provides a unique and universal combined wired and wireless solution for embedded design, industrial control, functionality testing, and parameter measurement instruments and functions. Our smart technology software utilizes a smartphone, computer, or a mobile device as an interface platform and display that communicates and works in tandem with a group of external sensors or probes, or both. The external sensors and probes may be manufactured by different vendors, but the universal smart technology functions in a manner that does not require the user to have extensive knowledge of the unique characteristics of the function of each of the sensors and probes. The universal smart instrument Focus developed (called the “Ubiquitor”) consists of a reusable foundation component which includes a wireless gateway (which allows the instrument to connect to the smartphone via Bluetooth and WiFi technology), universal smart application software (“Application”) which is installed on the user’s smartphone or other mobile device and allows monitoring of the sensor readouts on the smartphone screen. The Ubiquitor also connects to a variety of individual scientific sensors that collect data, from moisture, light, airflow, voltage, and a wide variety of applications. The data then sent through a wired or wireless connection, or a combination thereof to the smartphone or other mobile device and the data is organized and displayed on the smartphone screen. The smartphone or other mobile device, foundation, and sensor readouts together perform the functions of many traditional scientific and engineering instruments and are intended to replace the traditional, wired stand-alone instruments at a fraction of their cost.

Perfecular Inc. (“Perfecular”) was founded in September 2009 and is headquartered in Ontario, California, and is engaged in designing certain digital sensor products and sells a broad selection of horticultural sensors and filters in North America and Europe.

AVX Design & Integration, Inc. (“AVX”) was incorporated on June 16, 2000 in the state of California. AVX is an internet of things (“IoT”) installation and management company specializing in high performance and easy to use Audio/Video, Home Theater, Lighting Control, Automation and Integration. Services provided by AVX include full integration of houses, apartment, commercial complex, office spaces with audio, visual and control systems to fully integrate devices in the low voltage field. AVX’s services also include partial equipment upgrade and installation.

Note 2 – Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements include the accounts of Focus and its wholly-owned subsidiaries, Perfecular Inc. and AVX Design & Integration, Inc. (collectively, the “Company”, “we”, “our”, or “us”). All intercompany balances and transactions have been eliminated upon consolidation. The Company’s condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Going Concern

In the long term, the continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to repay its debt obligations, to obtain necessary equity financing to continue operations, and the attainment of profitable operations. For the period ended March 31, 2021, the Company had a net loss of $682,516 and negative cash flow from operating activities of $438,775. In Q1, 2021 the Company has obtained a $1,500,000 loan from a financial institution and has a $1,500,000 loan commitment from a private related party. The loan from the financial institution requires monthly payments with the final payment due in 2026. The related party loan will accrue interest at 10% until March 15, 2022, or six months from the date the loan is funded, whichever is later (the “Initial Interest Accrual Date”). Interest on any unpaid principal after Initial Interest Accrual Date shall accrue at a fixed rate of 12% per annum until paid. The Company reserves the right to prepay this loan agreement (in whole or in part) after 6 months of the first day with no prepayment penalty. The Company may make, in its sole discretion, payments of interest only, or interest and principal, provided that the principal is not paid in full prior to six months from the date the loan is funded. The Company also plans to raise $10 million through an underwritten public offering in 2021.

| F-5 |

With the January 1, 2021 beginning cash amount of $585,325 and the loan of $1,500,000, the Company will have enough cash to cover its projected annual cash burn rate of $1,967,074. With the additional $1,500,000 related party loan, the Company will have adequate reserves to continue operations in 2021 and 2022. The related party which will provide the loan to the Company is owned by a director of the Company, which we have evaluated to be a reliable source of cashflow. The $10 million planned public offering will contribute to a projected December 31, 2021 cash balance of $11,000,000. Historically, the Company has been successful in reaching planned its fund-raising targets.

In 2020 the Company had negative operating cashflow of approximately $1.96 million, mainly resulting from net loss. The Company is currently developing its products and licenses and expects to generate profit once the products and licenses are available for the market, which will begin to alleviate the negative cashflow. Currently, the Company is testing 4 Mbps ultra-narrowband power line communication printed circuit boards, the testing is expected to complete in Q2 2021. The ultra-narrowband power line communication products will launch in Q4, 2021. The portable universal smart device is also in the final printed circuit board layout stage, the Company is planning to launch this product in Q4 2021. Initially, new products would require cash to manufacture and promote. The Company expects to begin generating positive cashflow with the launch of above-mentioned products from Q2 of 2022.

Overall, we expect that with the loan we obtained, along with the committed related-party loan, and planned capital raising will provide adequate cash for the Company to continue operation as a going concern throughout 2021 and 2022. The Company expects the loans and offering will generate cash for 2021’s operation and be able to pay off the loans obtained through the offering with sufficient cashflow for 2021 and 2022. Thus, the previous factors raising substantial doubt to continue as a going concern have been alleviated.

Principles of Consolidation

The accompanying consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, Perfecular Inc. and AVX Design & Integration. Focus and Perfecular, collectively “the entities” were under common control; therefore, in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 805-50-45, the acquisition of Perfecular was accounted for as a business combination between entities under common control and treated similar to a pooling of interest transaction. On March 15, 2019, Focus entered into a stock purchase agreement with AVX whereby Focus purchased 100% of the outstanding stock of AVX. All significant intercompany transactions and balances have been eliminated.

Segment Reporting

The Company currently has two operating segments. In accordance with ASC 280, Segment Reporting (“ASC 280”), the Company considers operating segments to be components of the Company’s business for which separate financial information is available and evaluated regularly by management in deciding how to allocate resources and to assess performance. Management reviews financial information presented on a consolidated basis for purposes of allocating resources and evaluating financial performance. Accordingly, the Company has determined that it has two operating and reportable segments.

Asset information by operating segment is not presented as the chief operating decision maker does not review this information by segment. The reporting segments follow the same accounting policies used in the preparation of the Company’s unaudited condensed consolidated financial statements.

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities as of the date of the accompanying consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. The Company bases its estimates and assumptions on current facts, historical experience, and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources.

| F-6 |

The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected. Significant estimates in the accompanying financial statements include the lease term impacting right-of use asset and lease liability, useful lives of property and equipment, useful lives of intangible assets, allowance for doubtful accounts, inventory reserves, debt discounts, valuation of derivatives, and the valuation allowance on deferred tax assets. The Company regularly evaluates its estimates and assumptions.

Cash

The Company considers all highly liquid investments with a maturity of three months or less to be cash. At times, such investments may be in excess of Federal Deposit Insurance Corporation (FDIC) insurance limit. There were no cash equivalents held by the Company at March 31, 2021 and December 31, 2020.

Accounts Receivable

The Company grants credit to clients that sell the Company’s products or engage in construction service under credit terms that it believes are customary in the industry and do not require collateral to support customer receivables. The accounts receivable balances are generally collected within 30 to 90 days of the product sale.

Allowance for Doubtful Accounts

The Company estimates an allowance for doubtful accounts based on historical collection trends and review of the current status of trade accounts receivable. It is reasonably possible that the Company's estimate of the allowance for doubtful accounts will change. As of March 31, 2021 and December 31, 2020, allowance for doubtful accounts amounted to $52,876 and $44,519, respectively.

Concentrations of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist primarily of cash and cash equivalents. The Company limits its exposure to credit loss by investing its cash with high credit quality financial institutions.

Inventory

Inventory consists primarily of parts and finished goods and is valued at the lower of the inventory’s cost or net realizable value under the first-in-first-out method. Management compares the cost of inventory with its market value and an allowance is made to write down inventory to market value, if lower. Inventory allowances are recorded for obsolete or slow-moving inventory based on assumptions about future demand and marketability of products, the impact of new product introductions and specific identification of items, such as discontinued products. These estimates could vary significantly from actual requirements, for example, if future economic conditions, customer inventory levels, or competitive conditions differ from expectations. The Company regularly reviews the value of inventory based on historical usage and estimated future usage. If estimated realized value of our inventory is less than cost, we make provisions in order to reduce its carrying value to its estimated market value. As of March 31, 2021 and December 31, 2020, inventory reserve amounted to $67,275 and $70,562, respectively.

Property and Equipment

Property and equipment are stated at cost. The cost and accumulated depreciation of assets sold or retired are removed from the respective accounts and any gain or loss is included in earnings. Maintenance and repairs are expensed currently. Major renewals and betterments are capitalized. Depreciation is computed using the straight-line method. Estimated useful lives are as follows:

| Fixed assets | Useful life |

| Furniture | 5 years |

| Equipment | 5 years |

| Warehouse | 39 years |

| Improvement | 5 years |

| Construction in progress | – |

| Land | – |

| F-7 |

Long-Lived Assets

The Company applies the provisions of FASB ASC Topic 360, Property, Plant, and Equipment, which addresses financial accounting and reporting for the impairment or disposal of long-lived assets. ASC 360 requires impairment losses to be recorded on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets’ carrying amounts. In that event, a loss is recognized based on the amount by which the carrying value exceeds the fair value of the long-lived assets. Loss on long-lived assets to be disposed of is determined in a similar manner, except that fair values are reduced for the cost of disposal. Long-term assets of the Company are reviewed when circumstances warrant as to whether their carrying value has become impaired. The Company considers assets to be impaired if the carrying value exceeds the future projected cash flows from related operations. The Company also re-evaluates the periods of amortization to determine whether subsequent events and circumstances warrant revised estimates of useful lives. Based on its review at March 31, 2021 and December 31, 2020, the Company believes there was no impairment of its long-lived assets.

Share-based Compensation

The Company accounts for stock-based compensation to employees in conformity with the provisions of ASC Topic 718, Stock-Based Compensation. Stock-based compensation to employees consist of stock options grants and restricted shares that are recognized in the statement of operations based on their fair values at the date of grant.

The measurement of stock-based compensation is subject to periodic adjustments as the underlying equity instruments vest and is recognized as an expense over the period during which services are received.

The Company calculates the fair value of option grants utilizing the Black-Scholes pricing model and estimates the fair value of the stock based upon the estimated fair value of the common stock. The amount of stock-based compensation recognized during a period is based on the value of the portion of the awards that are ultimately expected to vest.

The resulting stock-based compensation expense for both employee and non-employee awards is generally recognized on a straight- line basis over the requisite service period of the award.

Fair Value of Financial Instruments

The Company follows paragraph ASC 825-10-50-10 for disclosures about fair value of its financial instruments and paragraph ASC 820-10-35-37 (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 establishes a framework for measuring fair value in accounting principles generally accepted in the United States of America (U.S. GAAP), and expands disclosures about fair value measurements.

To increase consistency and comparability in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three (3) levels of fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

| ☐ | Level 1: Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. |

| ☐ | Level 2: Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. |

| ☐ | Level 3: Pricing inputs that are generally unobservable inputs and not corroborated by market data. |

Financial assets are considered Level 2 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least one significant model assumption or input is unobservable.

The carrying amount of the Company’s financial assets and liabilities, such as cash, prepaid expenses, accounts payable, and accrued expenses, approximate their fair value because of the short maturity of those instruments.

| F-8 |

Transactions involving related parties cannot be presumed to be carried out on an arm's-length basis, as the requisite conditions of competitive, free-market dealings may not exist. Representations about transactions with related parties, if made, shall not imply that the related party transactions were consummated on terms equivalent to those that prevail in arm's-length transactions unless such representations can be substantiated.

However, it is not practical to determine the fair value of advances from stockholders, if any, due to their related party nature.

Revenue Recognition

On September 1, 2018, the Company adopted ASC 606 – Revenue from Contracts with Customers using the modified retrospective transition approach. The core principle of ASC 606 is that revenue should be recognized in a manner that depicts the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled for exchange of those goods or services. The Company’s updated accounting policies and related disclosures are set forth below, including the disclosure for disaggregated revenue. The impact of adopting ASC 606 was not material to the Condensed Consolidated Financial Statements.

Revenue from the Company is recognized under Topic 606 in a manner that reasonably reflects the delivery of its services and products to customers in return for expected consideration and includes the following elements:

| ☐ | executed contracts with the Company’s customers that it believes are legally enforceable; |

| ☐ | identification of performance obligations in the respective contract; |

| ☐ | determination of the transaction price for each performance obligation in the respective contract; |

| ☐ | allocation of the transaction price to each performance obligation; and |

| ☐ | recognition of revenue only when the Company satisfies each performance obligation. |

These five elements, as applied to each of the Company’s revenue categories, is summarized below:

| ☐ | Product sales – revenue is recognized at the time of sale of equipment to the customer. |

| ☐ | Service sales – revenue is recognized based on the service been provided to the customer. |

Revenue from construction projects is recognized over time using the percentage-of-completion method under the cost approach. The percentage of completion is determined by estimating stage of work completed. Under this approach, recognized contract revenue equals the total estimated contract revenue multiplied by the percentage of completion. Our construction contracts are unit priced, and an account receivable is recorded for amounts invoiced based on actual units produced.

Cost of Revenue

Cost of revenue includes the cost of services, labor, and product incurred to provide product sales, service sales, and project sales.

Research and Development

Research and development costs are expensed as incurred. Research and development costs primarily consist of efforts to refine existing product models and develop new product models.

| F-9 |

Related Parties

The Company follows ASC 850-10 for the identification of related parties and disclosure of related party transactions. Pursuant to ASC 850-10-20 the related parties include: a) affiliates of the Company; b) entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of ASC 825–10–15, to be accounted for by the equity method by the investing entity; c) trusts for the benefit of employees, such as pension and profit-sharing trusts that are managed by or under the trusteeship of management; d) principal owners of the Company; e) management of the Company; f) other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g) other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The condensed consolidated financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated financial statements is not required in those statements. The disclosures shall include: (a) the nature of the relationship(s) involved; (b) a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the consolidated financial statements; (c) the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and (d) amounts due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

Commitments and Contingencies

The Company follows ASC 450-20 to report accounting for contingencies. Certain conditions may exist as of the date the consolidated financial statements are issued, which may result in a loss to the Company, but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s consolidated financial statements. If the assessment indicates that a potential material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. Management does not believe, based upon information available at this time that these matters will have a material adverse effect on the Company’s financial position, results of operations or cash flows. However, there is no assurance that such matters will not materially and adversely affect the Company’s business, financial position, and results of operations or cash flows.

Income Tax Provision

The Company accounts for income taxes in accordance with ASC Topic 740, Income Taxes (ASC 740). ASC 740 requires a company to use the asset and liability method of accounting for income taxes, whereby deferred tax assets are recognized for deductible temporary differences, and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, the Company does not foresee generating taxable income in the near future and utilizing its deferred tax asset, therefore, it is more likely than not that some portion, or all of, the deferred tax assets will not be realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment.

| F-10 |

Under ASC 740, a tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is more than 50% likely to be realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded. The Company has no material uncertain tax positions for any of the reporting periods presented.

Income taxes are accounted for using the asset and liability method. Deferred income taxes are provided for temporary differences in recognizing certain income, expense, and credit items for financial reporting purposes and tax reporting purposes. Such deferred income taxes primarily relate to the difference between the tax basis of assets and liabilities and their financial reporting amounts. Deferred tax assets and liabilities are measured by applying enacted statutory tax rates applicable to the future years in which deferred tax assets or liabilities are expected to be settled or realized. There was no material deferred tax asset or liabilities as of September 30, 2020 and December 31, 2019.

As of March 31, 2021 and December 31, 2020, the Company did not identify any material uncertain tax positions.

Basic and Diluted Net Income (Loss) Per Share

Net income (loss) per share is computed pursuant to ASC 260-10-45. Basic net income (loss) per share (“EPS”) is computed by dividing net income (loss) by the weighted average number of shares outstanding during the period.

Diluted EPS is computed by dividing net income (loss) by the weighted average number of shares of stock and potentially outstanding shares of stock during the period to reflect the potential dilution that could occur from common shares issuable through contingent shares issuance arrangement, stock options or warrants.

Due to the net loss incurred by the Company, potentially dilutive instruments would be anti-dilutive. Accordingly, diluted loss per share is the same as basic loss for all periods presented. The following potentially dilutive shares were excluded from the shares used to calculate diluted earnings per share as their inclusion would be anti-dilutive.

| Three months ended March 31, | 2021 | 2020 | ||||||

| Stock options | 236,250 | 140,000 | ||||||

| Total | 236,250 | 140,000 | ||||||

Subsequent Events

The Company follows the guidance in ASC 855-10-50 for the disclosure of subsequent events. The Company will evaluate subsequent events through the date when the financial statements were issued. Pursuant to ASU 2010-09, the Company as an SEC filer considers its financial statements issued when they are widely distributed to users, such as through filing them on EDGAR. Based upon the review, other than described in Note 14 – Subsequent Events, the Company did not identify any recognized or non-recognized subsequent events that would have required adjustment or disclosure in the condensed consolidated financial statements.

Reclassification

Certain reclassifications have been made to the condensed consolidated financial statements for prior years to the current year’s presentation. Such reclassifications have no effect on net income as previously reported.

Note 3 – Recent Accounting Pronouncement

Recently Adopted Accounting Standards

In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update (“ASU”) 2016-02, Leases (Topic 842) (“Topic 842”), which requires lessees to recognize leases on the balance sheet and disclose key information about leasing arrangements. Topic 842 was subsequently amended by ASU 2018-01, Land Easement Practical Expedient for Transition to Topic 842; ASU 2018-10, Codification Improvements to Topic 842, Leases; ASU 2018-11, Targeted Improvements; and ASU 2019-01, Codification Improvements. The new standard establishes a right-of-use model (“ROU”) that requires a lessee to recognize ROU asset and lease liability on the balance sheet for all leases with a term longer than 12 months. Leases are classified as finance or operating, with classification affecting the pattern and classification of expense recognition in the statement of income.

| F-11 |

The new standard was effective for the Company on January 1, 2019. A modified retrospective transition approach is required, applying the new standard to all leases existing at the date of initial application. An entity may choose to use either (1) its effective date or (2) the beginning of the earliest comparative period presented in the financial statements as its date of initial application. The Company adopted the new standard on January 1, 2019 and used the effective date as its date of initial application. Consequently, prior period financial information has not been recast and the disclosures required under the new standard have not been provided for dates and periods before January 1, 2019.

The new standard provides a number of optional practical expedients in transition. The Company elected the “package of practical expedients,” which permits it not to reassess under the new standard its prior conclusions about lease identification, lease classification and initial direct costs. The Company did not elect the use-of-hindsight or the practical expedient pertaining to land easements, the latter not being applicable to the Company. The new standard also provides practical expedients for an entity’s ongoing accounting. The Company elected the short-term lease recognition exemption for all leases that qualify. This means, for those leases that qualify, it has not recognized ROU assets or lease liabilities, and this includes not recognizing ROU assets or lease liabilities for existing short-term leases of those assets in transition. The Company also elected the practical expedient to not separate lease and non-lease components for all of its leases.

The Company believes the most significant effects of the adoption of this standard relate to (1) the recognition of new ROU assets and lease liabilities on its consolidated balance sheet for its office operating leases and (2) providing new disclosures about its leasing activities. There was no change in its leasing activities as a result of adoption.

In June 2018, the FASB issued ASU 2018-07, Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting, which simplifies the accounting for share-based payments granted to nonemployees for goods and services and aligns most of the guidance on such payments to nonemployees with the requirements for share-based payments granted to employees. ASU 2018-07 is effective on January 1, 2019. Early adoption is permitted. The adoption of this ASU did not have a material impact on the Company’s consolidated financial statements.

In June 2020, the FASB issued ASU 2020-05 in response to the ongoing impacts to U.S. businesses in response to the COVID-19 pandemic. ASU 2020-05, Revenue from Contracts with Customers (Topic 606) and Leases (Topic 842) Effective Dates for Certain Entities provide a limited deferral of the effective dates for implementing previously issued ASU 606 and ASU 842 to give some relief to businesses considering the difficulties they are facing during the pandemic. These entities may defer application to fiscal years beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020. As the Company has already adopted ASU 606 and ASU 842, the Company does not anticipate any effect on its financial statements.

Recently Issued Accounting Standards Not Yet Adopted

In June 2016, FASB issued ASU 2016-13, Financial Instruments - Credit Losses, which changes the accounting for recognizing impairments of financial assets. Under the new guidance, credit losses for certain types of financial instruments will be estimated based on expected losses. The new guidance also modifies the impairment models for available-for-sale debt securities and for purchased financial assets with credit deterioration since their origination. In February 2020, the FASB issued ASU 2020-02, Financial Instruments-Credit Losses (Topic 326) and Leases (Topic 842) - Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin No. 119 and Update to SEC Section on Effective Date Related to Accounting Standards Update No. 2016-02, Leases (Topic 842), which amends the effective date of the original pronouncement for smaller reporting companies. ASU 2016-13 and its amendments will be effective for the Company for interim and annual periods in fiscal years beginning after December 15, 2022. The Company believes the adoption will modify the way the Company analyzes financial instruments, but it does not anticipate a material impact on results of operations. The Company is in the process of determining the effects the adoption will have on its consolidated financial statements.

In December 2019, FASB issued ASU 2019-12, Income Taxes, which provides for certain updates to reduce complexity in the accounting for income taxes, including the utilization of the incremental approach for intra-period tax allocation, among others. The amendments in ASU 2019-12 are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2020. The Company does not expect the implementation of ASU 2019-12 to have a material effect on its consolidated financial statements.

Management does not believe that any recently issued, but not yet effective, accounting standards could have a material effect on the accompanying financial statements. As new accounting pronouncements are issued, we will adopt those that are applicable under the circumstances.

| F-12 |

Note 4 – Inventory, net

At March 31, 2021 and December 31, 2020, inventory consisted of the following:

| March 31, 2021 |

December 31, 2020 |

|||||||

| Parts | $ | 40,180 | $ | 45,509 | ||||

| Finished goods | 51,903 | 67,549 | ||||||

| Total | 92,083 | 113,058 | ||||||

| Less inventory reserve | (67,275 | ) | (70,562 | ) | ||||

| Inventory, net | $ | 24,808 | $ | 42,496 | ||||

Note 5 – Deposit

Deposit balance as of March 31, 2021 amounted to $6,630 for lease agreement deposit. Deposit balance as of December 31, 2020 amounted to $106,630, including $6,630 for lease agreement deposit and $100,000 for payment made into an escrow account for purchasing a target company. On March 26, 2021, the management of CWS decided to terminate the LOI. The LOI was terminated effective as of March 29, 2021 and $100,000 was returned on March 29, 2021.

Note 6 – Property and Equipment

At March 31, 2020 and December 31, 2019, property and equipment consisted of the following:

| March 31, 2021 |

December 31, 2020 |

|||||||

| Warehouse | $ | 3,789,773 | $ | 3,789,773 | ||||

| Land | 731,515 | 731,515 | ||||||

| Building Improvement | 238,666 | 238,666 | ||||||

| Furniture and fixture | 27,631 | 27,631 | ||||||

| Equipment | 48,378 | 48,378 | ||||||

| Software | 1,995 | 1,995 | ||||||

| Total cost | 4,837,958 | 4,837,958 | ||||||

| Less accumulated depreciation | (385,985 | ) | (345,448 | ) | ||||

| Property and equipment, net | $ | 4,451,973 | $ | 4,492,510 | ||||

Depreciation expense for the three months ended March 31, 2021 and 2020 amounted to $40,537 and $40,598, respectively.

The Company purchased a warehouse in Ontario, California in September 2018 and leased an unused portion to a third party. The tenant paid $12,335 as a security deposit, shown as other liability in non-current liability.

Note 7 – Related Party Transactions

Revenue generated from Vitashower Corp., a company owned by the CEO’s wife, amounted to $10,191 and $14,672 for the three months ended March, 2021 and 2020, respectively. Account receivable balance due from Vitashower Corp. amounted to $0 and $0 as of March 31, 2021 and December 31, 2020, respectively.

Compensation for services provided by the President and Chief Executive Officer for the three months ended March 31, 2021 and 2020 amounted to $30,000 and $30,000, respectively.

| F-13 |

Note 8 – Business Concentration and Risks

Major customers

One customer accounted for 48% and 17% of the total accounts receivable as of March 31, 2021 and December 31, 2020, respectively. This customer accounted for 80% and 58% of the total revenue for the period ended March 31, 2021 and 2020, respectively.

Major vendors

One vendor accounted for 96% and 0% of total accounts payable at March 31, 2021 and December 31, 2020, respectively. This vendor accounted for 84% and 38% of the total purchases for the period ended March 31, 2021 and 2020, respectively.

Note 9 – Operating Lease Right-of-use Asset and Operating Lease Liability

Operating lease right-of-use assets and liabilities are recognized at the present value of the future lease payments at the lease commencement date. The interest rate used to determine the present value is our incremental borrowing rate, estimated to be 15%, as the interest rate implicit in our lease is not readily determinable. During the three months ended March 31, 2021 and 2020, the Company recorded $16,295 and $16,295, respectively as operating lease expense.

The Company currently has a lease agreement for AVX’s operation for a monthly payment of $5,258 and shall increase by 3% every year. The lease commenced July 1, 2015 and expires on August 31, 2022. A security deposit of $5,968 was also held for the duration of the lease term.

In adopting ASC Topic 842, Leases (Topic 842), the Company has elected the ‘package of practical expedients,’ which permit it not to reassess under the new standard its prior conclusions about lease identification, lease classification and initial direct costs. The Company did not elect the use-of-hindsight or the practical expedient pertaining to land easements; the latter is not applicable to the Company. In addition, the Company elected not to apply ASC Topic 842 to arrangements with lease terms of 12 months or less. On March 15, 2019 when AVX was acquired, upon adoption of ASC Topic 842, the Company recorded a right-of-use asset.

Right-of-use asset is summarized below:

| March 31, 2021 | March 31, 2020 | |||||||

| Office lease | $ | 157,213 | $ | 157,213 | ||||

| Less: accumulated amortization | (82,197 | ) | (38,669 | ) | ||||

| Right-of-use asset, net | $ | 75,016 | $ | 118,544 | ||||

Operating Lease liability is summarized below:

| March 31, 2021 | March 31, 2020 | |||||||

| Office lease | $ | 73,025 | $ | 128,707 | ||||

| Less: current portion | (55,890 | ) | (46,415 | ) | ||||

| Long-term portion | $ | 17,135 | $ | 82,292 | ||||

Maturity of lease liability is as follows:

| Year ending December 31, 2021 | $ | 48,273 | ||

| Year ending December 31, 2022 | 43,655 | |||

| Total future minimum lease payment | 91,928 | |||

| Imputed interest | (9,636 | ) | ||

| Lease Obligation, net | $ | 82,292 |

| F-14 |

Note 10 – Loans

Paycheck Protection Program

On April 24, 2020, AVX Design & Integration, Inc. entered into an agreement to receive a U.S. Small Business Administration Loan (“SBA Loan”) from JPMorgan Chase Bank, N.A. related to the COVID-19 pandemic in the amount of $116,460, which we received on May 1, 2020. The SBA Loan has a fixed interest rate of 0.98 percent per annum and a maturity date two years from the date the loan was issued.

On May 4, 2020, Perfecular Inc. entered into an agreement to receive a U.S. Small Business Administration Loan (“SBA Loan”) from Bank of America related to the COVID-19 pandemic in the amount of $151,500, which we received on May 4, 2020. The SBA Loan has a fixed interest rate of 1 percent per annum and a maturity date two years from the date loan was issued.

On March 2, 2021, Perfecular Inc. entered into an agreement to receive a U.S. Small Business Administration Loan (“SBA Loan”) from Wells Fargo related to the COVID-19 pandemic in the amount of $158,547, which we received on March 3, 2021. The SBA Loan has a fixed interest rate of 1 percent per annum and a maturity date two years from the date loan was issued.

On March 10, 2021, AVX Design & Integration, Inc. entered into an agreement to receive an SBA Loan from Chase Bank related to the COVID-19 pandemic in the amount of $108,750. The SBA Loan has a fixed interest rate of 0.98 percent per annum and a maturity date five years from the date loan was issued.

Economic Injury Disaster Loan

On June 4, 2020, Perfecular Inc. entered into an agreement to receive a U.S. Small Business Administration Loan (“SBA Loan”) from Bank of America related to the COVID-19 pandemic in the amount of $81,100, which we received on June 4, 2020. The SBA Loan has a fixed interest rate of 3.75 percent per annum and a maturity date thirty years from the date loan was issued.

On June 5, 2020, AVX Design & Integration, Inc. entered into an agreement to receive a U.S. Small Business Administration Loan (“SBA Loan”) from JPMorgan Chase Bank, N.A. related to the COVID-19 pandemic in the amount of $56,800, which we received on June 5, 2020. The SBA Loan has a fixed interest rate of 3.75 percent per annum and a maturity date thirty years from the date loan was issued.

Bank Loan

On January 8, 2021, Focus Universal Inc. entered into a secured promissory note agreement with East West Bank in the amount of $1,500,000. The note has a variable interest rate of 0.25% above Wall Street Journal Prime Rate. The note requires monthly payments with the final payment of $1,357,178 due on January 22, 2026.

Borrower will use all of the proceeds from this Loan solely as working capital to alleviate economic injury caused by disaster occurring in the month of January 31, 2020 and continuing thereafter.

| March 31, 2021 | December 31, 2020 | |||||||

| SBA Loan | $ | 664,157 | $ | 396,860 | ||||

| Bank Loan | 1,496,400 | – | ||||||

| Total | 2,160,557 | 396,860 | ||||||

| Less: current portion | (355,021 | ) | (194,125 | ) | ||||

| Long term portion | $ | 1,805,536 | $ | 202,735 | ||||

Interest expense incurred from the loans amounted to $7,565 and $0 for the three months ended March 31, 2021 and 2020, respectively.

| F-15 |

Note 11 – Stockholders’ Equity

Shares authorized

Upon formation, the total number of shares of all classes of stock that the Company is authorized to issue is seventy-five million (75,000,000) shares of common stock, par value $0.001 per share.

Common stock

As of March 31, 2021 the Company had 40,959,741 shares of common stock issued and outstanding.

During the three months ended March 31, 2021, the Company did not issue common stock.

Shares to be issued for compensation

The Company entered into agreements with third party consultants for financing and management consultation. The Company has incurred consulting service fees not paid in cash amounting to $12,000 for the period ended March 31, 2021, which the Company intends to issue stock as compensation for services rendered. Expenses incurred but not yet paid in shares as of March 31, 2021 and 2020 amounted to $110,709 and $62,709, respectively.

Stock options

On January 4, 2021, each member of the Board was granted 15,000 options to purchase shares at $3.00 per share.

On August 6, 2019, each member of the Board was granted 30,000 options to purchase shares at $5.70 per share.

As of March 31, 2021, there were 315,000 options granted, 236,250 options vested, 0 options unvested, and 315,000 outstanding stock options.

For the three months ended March 31, 2021 and 2020, the Company’s stock option compensation expenses amounted to $259,350 and $106,838, respectively.

The fair value of the warrants listed above was determined using the Black-Scholes option pricing model with the following assumptions:

| March 31, | March 31, | |||||||

| 2021 | 2020 | |||||||

| Risk-free interest rate | 0.93% | 1.71% | ||||||

| Expected life of the options | 10 years | 10 years | ||||||

| Expected volatility | 122.93% | 158.86% | ||||||

| Expected dividend yield | 0% | 0% | ||||||

The following is a summary of options activity from December 31, 2020 to March 31, 2021:

| Options | Shares | Weighted average exercise price | Weighted Average Remaining Contractual Life | Aggregate Intrinsic Value | ||||||||||||

| Outstanding at December 31, 2020 | 210,000 | $ | 9.61 | 9.61 | – | |||||||||||

| Granted | 105,000 | 1.00 | – | – | ||||||||||||

| Exercised | – | – | – | – | ||||||||||||

| Forfeited or expired | – | – | – | – | ||||||||||||

| Outstanding at March 31, 2021 | 315,000 | $ | 4.80 | 8.83 | 131,250 | |||||||||||

| Vested as of March 31, 2021 | 236,250 | $ | 5.40 | 8.51 | 32,813 | |||||||||||

| Exercisable at March 31, 2021 | 315,000 | $ | 5.40 | 8.51 | 32,813 | |||||||||||

| F-16 |

The exercise price for options outstanding and exercisable at March 31, 2021:

| Outstanding | Exercisable | |||||||||||

| Number of | Exercise | Number of | Exercise | |||||||||

| Options | Price | Options | Price | |||||||||

| 30,000 | $ | 5.70 | 30,000 | $ | 5.70 | |||||||

| 30,000 | 5.70 | 30,000 | 5.70 | |||||||||

| 30,000 | 5.70 | 30,000 | 5.70 | |||||||||

| 30,000 | 5.70 | 30,000 | 5.70 | |||||||||

| 30,000 | 5.70 | 30,000 | 5.70 | |||||||||

| 30,000 | 5.70 | 30,000 | 5.70 | |||||||||

| 30,000 | 5.70 | 30,000 | 5.70 | |||||||||

| 15,000 | 3.00 | 15,000 | 3.00 | |||||||||

| 15,000 | 3.00 | 15,000 | 3.00 | |||||||||

| 15,000 | 3.00 | 15,000 | 3.00 | |||||||||

| 15,000 | 3.00 | 15,000 | 3.00 | |||||||||

| 15,000 | 3.00 | 15,000 | 3.00 | |||||||||

| 15,000 | 3.00 | 15,000 | 3.00 | |||||||||

| 15,000 | 3.00 | 15,000 | 3.00 | |||||||||

| 315,000 | 315,000 | |||||||||||

Note 12 – Segment reporting

The Company consists of two types of operations. Focus Universal, Inc. and Perfecular Inc. (“Focus”) involve wholesale, research and development of universal smart instrument and farming devices. AVX Design & Integration, Inc. (“AVX”) is an IoT installation and management company specializing in high performance and easy to use audio/video, home theater, lighting control, automation, and integration. The table below discloses income statement information by segment.

| Three months ended March 31, 2021 | ||||||||||||

| Focus | AVX | Total | ||||||||||

| Revenue | $ | 313,530 | $ | 39,742 | $ | 353,272 | ||||||

| Revenue - related party | 10,191 | – | 10,191 | |||||||||

| Total revenue | 323,721 | 39,742 | 363,463 | |||||||||

| Cost of Revenue | 254,223 | 38,040 | 292,263 | |||||||||

| Gross Profit | 69,498 | 1,702 | 71,200 | |||||||||

| Operating Expenses: | ||||||||||||

| Selling | 332 | 180 | 512 | |||||||||

| Compensation - officers | 39,100 | – | 39,100 | |||||||||

| Research and development | 63,150 | – | 63,150 | |||||||||

| Professional fees | 376,633 | 914 | 377,547 | |||||||||

| General and administrative | 239,513 | 70,571 | 310,084 | |||||||||

| Total Operating Expenses | 718,728 | 71,665 | 790,393 | |||||||||

| Loss from Operations | (649,230 | ) | (69,963 | ) | (719,193 | ) | ||||||

| Other Income (Expense): | ||||||||||||

| Interest income (expense), net | (6,670 | ) | (863 | ) | (7,533 | ) | ||||||

| Interest (expense) – related party | – | – | – | |||||||||

| Other income (expense), net | 45,385 | (1,175 | ) | 44,210 | ||||||||

| Total other income (expense) | 38,715 | (2,038 | ) | 36,677 | ||||||||

| Loss before income taxes | (610, 515 | (72,003 | ) | (682,516 | ) | |||||||

| Tax expense | – | – | – | |||||||||

| Net Loss | $ | (610,515 | ) | $ | (72,003 | ) | $ | (682,516 | ) | |||

| F-17 |

Note 13 – Commitments and Contingencies

In the normal course of business or otherwise, the Company may become involved in legal proceedings. The Company will accrue a liability for such matters when it is probable that a liability has been incurred and the amount can be reasonable estimated. When only a range of possible loss can be established, the most probable amount in the range is accrued. The accrual for a litigation loss contingency might include, for example, estimates of potential damages, outside legal fees, and other directly related costs expected to be incurred.

Note 14 – Subsequent Events

The Company has evaluated all other subsequent events through the date these condensed consolidated financial statements were issued and determine that there were no subsequent events or transactions that require recognition or disclosures in the condensed consolidated financial statements.

| F-18 |

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS AND PLAN OF OPERATION

The following discussion of our financial condition and results of operations should be read in conjunction with, and is qualified in its entirety by, the consolidated financial statements and notes thereto included in, Item 1 in this Quarterly Report on Form 10-Q. This item contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those indicated in such forward-looking statements.

Forward-Looking Statements

This Quarterly Report on Form 10-Q and the documents incorporated herein by reference contain forward-looking statements. Such forward-looking statements are based on current expectations, estimates, and projections about our industry, management beliefs, and certain assumptions made by our management. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict; therefore, actual results may differ materially from those expressed or forecasted in any such forward-looking statements. Unless required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. However, readers should carefully review the risk factors set forth herein and in other reports and documents that we file from time to time with the Securities and Exchange Commission, particularly the Report on Form 10-K, Form 10-Q and any Current Reports on Form 8-K.

Narrative Description of the Business

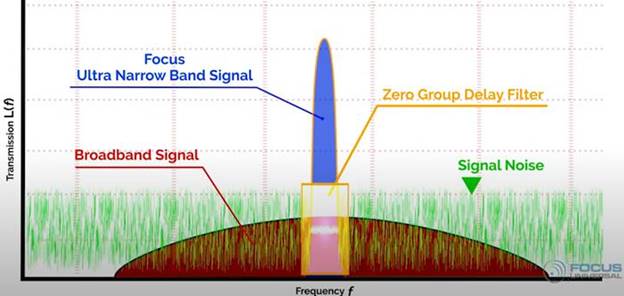

Focus Universal Inc. (the “Company,” “we,” “us,” or “our”) is a Nevada corporation. We have developed four fundamental disruptive proprietary technologies which we believe solve the most fundamental problems plaguing the internet of things (“IoT”) industry through: (1) increasing overall chip integration by shifting it to the device level; (2) creating a faster 5G cellular technology by using Ultra-narrowband technology; (3) leveraging ultra-narrowband power line communication (“PLC”) technology; and (4) User Interface Machine auto generation technology. Our Universal smart technology is designed to overcome instrumentation interoperability and interchangeability. The electronic design starts from a 90% completed common foundation we call our universal smart instrumentation platform (“USIP”), instead of the current method of building each stand-alone instrument from scratch. Our method eliminates redundant hardware and software and results in significant cost savings and production efficiency. We have developed software machine auto generation technology to replace the manual software designs which are currently in use and cannot satisfy the exponential growth of future IoT industry demand. Our ultra-narrowband PLC enables our users to send data over existing electricity power cables and immediately establish a ubiquitous data network without substantial new investment for a dedicated wiring infrastructure. Our ultra-narrow band technology is capable of overcoming the noise problems communicating through power lines that have hindered our competitors for over a century. Our wireless communication technology allows for longer-range coverage, is more energy effective and has much faster data sending speeds than the current 5G technology speeds being used. We also provide sensor devices and are a wholesaler of various air filters and digital, analog, and quantum light meter systems.

For the three months ended March 31, 2021 and 2020, we generated significant amount of our revenue from sales of a broad selection of agricultural sensors and measurement equipment which is currently our primary business.

Our Current Products Include:

Products we are currently selling

We are also a wholesaler of various digital, analog, and quantum light meters and filtration products, including fan speed adjusters, carbon filters and HEPA filtration systems. We source these products from manufacturers in China and then sell them to a major U.S. distributor, Hydrofarm, who resells our products directly to consumers through retail distribution channels and in some cases, places its own branding on our products.

| 4 |

Specifically, we sell the following products:

Fan speed adjuster device. We provide a fan speed adjuster device to our client Hydrofarm. Designed specifically for centrifugal fans with brushless motors, our adjuster device helps ensure longer life by preventing damage to fan motors by adjusting the speed of centrifugal fans without causing the motor to hum. These devices are rated for 350 watts max, have 120VAC voltage capacity and feature an internal, electronic auto-resetting circuit breaker.

Our Fan Speed Adjuster Device

Carbon filter devices. We sell two types of carbon filter devices to our client Hydrofarm. These carbon filter devices are professional grade filters specifically designed and used to filter air in greenhouses that might be polluted by fermenting organics. One of these filters can be attached to a centrifugal fan to scrub the air in a constant circle or can be attached to an exhaust line as a single pass filter, which moves air out of the growing area and filters unwanted odors and removes pollens, dust, and other debris in the air. The other filter is designed to be used with fans from 0-6000 C.F.M.

Our Carbon Filter Device

HEPA filtration device. We provide a high-efficiency particulate arrestance (“HEPA”) filtration device at wholesale prices to our client Hydrofarm. Manufactured, tested, certified, and labeled in accordance with current HEPA filter standards, this device is targeted towards greenhouses and grow rooms and designed to keep insects, bacteria, and mold out of grow rooms. We sell these devices in various sizes.

Our HEPA Filtration Device

| 5 |

Digital light meter. We provide a handheld digital light meter that is used to measure luminance in fc units, or foot-candles.

Our Digital Light Meter Device

Quantum par meter. We provide a handheld quantum par meter used to measure photosynthetically active radiation (“PAR”). This fully portable handheld PAR meter is designed to measure PAR flux in wavelengths ranging from 400 to 700 nm. It is designed to measure up to 10,000 µmol.

Our Quantum Par Meter Device

Strategy behind the AVX Acquisition

On March 15, 2019, the Company completed a transaction with Patrick Calderone to purchase 100% of the outstanding stock of AVX, an IoT installation and management company based in southern California.

Through our acquisition of AVX, we are planning to offer ordinary families an entire smart home product line at a fraction of the current market price. We have finished the design of smart lighting control, air conditioner, sprinkler, garden light control, garage door control and heating control. We are developing a swimming pool control device, smoke detector and carbon monoxide monitor. We believe these product lines could be completed by the end of 2021.

| 6 |

Ubiquitor Wireless Universal Sensor Device

Our USIP technology is an advanced software and hardware integrated instrumentation platform that uses a large-scale modular design approach. The large-scale modular design approach subdivides instruments into a foundation component (a USIP) and architecture-specific components (sensor nodes), which together replaces the functions of traditional instruments at a fraction of their cost. The USIP has an open architecture, incorporating a variety of individual instrument functions, sensors, and probes from different industries and vendors. The platform features the ability to connect potentially thousands of different sensors or probes, addressing major limitations present in traditional instrumentation systems. We believe the platform represents a technological advancement in the IoT marketplace by integrating large numbers of technologies, including cloud technology, wired and wireless communication technology, software programming, instrumentation technology, artificial intelligence, PLC, and sensor networking into a single platform. The result of such integration is a smaller, cheaper and faster circuit system design than those currently offered in the instrumentation market.

The USIP, which is compatible with a significant percentage of the instruments currently manufactured, consists of universal and reusable hardware and software. The universal hardware in the USIP is (i) a smartphone, computer, or any mobile device capable of running our software that includes a display and either hardware controls or software control surfaces, and (ii) our Ubiquitor, which is designed to be the universal data logger that acts as a bridge between the computer or mobile device and the sensor nodes. We call our flagship USIP device the “Ubiquitor” due to its ability to measure and test a variety of electrical and physical phenomena such as voltage, current, temperature, pressure, sound, light, and humidity—both wired and wirelessly.

We have created and assembled prototype models of the Ubiquitor in limited quantities and plan to expand our assembly in 2021. Our prototype Ubiquitor is compatible with standard desktop computers running either Windows OS or MacOS and Android- or iOS-based mobile devices and acts as a conduit that communicates with a group of sensors or probes manufactured by different vendors in a manner that requires the user to have little or no knowledge of their unique specifications. The data readout is displayed on the computer or mobile device display in application software we have created for use with a Windows PC and are creating for use with a Mac. We are designing the application software (the “App”) to have a graphical representation of control and indicator elements common in traditional tangible instruments, such as knobs, buttons, dials, and graphs, etc. Utilizing the Ubiquitor and the App, users and instrument manufacturers will be free to add, remove or change a sensor module for their special industrial or educational application without needing to create their own application software and design their own hardware. Our developers are designing and implementing a soft control touch screen interface that supports real-time data monitoring and facilitates instrument control and operation.

Recently, the Company has devoted a substantial number of resources to research and development to bring the Ubiquitor and its App to full production and distribution. We anticipate that the sales and marketing involved with bringing the Ubiquitor to market will require us to hire a number of new employees in order to gain traction in the market. We intend to introduce the Ubiquitor in smart home installations to reduce costs and increase functionality, as well as implement the Ubiquitor device in greenhouses and other agricultural warehouses that require regulation of light, humidity, moisture, and other measurable scientific units required to create optimal growing conditions.

Our universal smart development protocol focuses not only on the design of the hardware and software modules but also on the design of the overall universal smart instruments system, guided by the principles of structure, universality and modularity.

Our Ubiquitor device is a fully modular system with a universal sensor node and gateway system that uses a computer or mobile device as the output display module responsible for displaying the readings of various sensor nodes. We have completed an initial production run of prototype Ubiquitor devices and intend to proceed into full-scale production. The Ubiquitor’s sensor analytics system integrates event-monitoring, storage and analytics software in a cohesive package that provides a holistic view of the sensor data it is reading.

| 7 |

The physical hardware consists of:

| 1. | The sensor nodes, which come in hundreds of different varieties of sensor instruments in the form of a USB stick, with both male and female ports; and |

| 2. | The Ubiquitor as the main hardware gateway, which is a small cell phone-sized device with integrated circuits. |

We believe the Ubiquitor device can connect up to thousands of potential sensor nodes, and integrate data using embedded software to display the data and all analytics onto a digital screen (desktop, smartphone or mobile device displays) using a Wi-Fi connection. As disclosed in our patent application, we have already tested up to 256 sensor instrument readouts. Most types of nodes and probes can connect to the hardware. If the sensor size is bigger than the standard probe size, it is possible to simply use a USB cable to connect the probe and the hub. All data and analytics are displayed on a single screen, with tools that record and keep track of all measurements, and sort and display analytic information in easy-to-read charts.

The Ubiquitor is a general platform that collects data in real time, up to 100 Hz per second; and thus, is intended to be adapted to many industrial uses.

By using the universal hardware or USIP, we believe we could achieve the following efficiencies in instrumentation systems:

| 1. | Cut production costs. Smartphone technology is widely used on the small sensor device market. By utilizing smartphone technology, the Ubiquitor will add superior functionality and performance, improve the product’s quality and cut production costs. |

| 2. | Reduce the effort required to develop a new sensor product. With the Ubiquitor, we believe that there will be no need for device manufacturers to research and develop new monitoring and operating components because they will just need to develop new sensor nodes or probes that may be integrated into our software technology. |

| 3. | Reduce clutter. It is anticipated that the Ubiquitor could dispense with some of the hassle of connecting cables, since the Ubiquitor allows wireless transmission of sensor data and may allow wireless access to networks, such as a PLC network. |

We have not yet started research and development of a second generation Ubiquitor device, but once we demonstrate the market for this product, we intend to begin such research and development. Currently our research and development is focused on concepts we can implement in the current first generation Ubiquitor device.

| 8 |

Research and Development Efforts of Power Line Communication

Power Line Communication (“PLC”) is a communication technology that enables sending data over existing power cables. One advantage of this technology is that PLC does not require substantial new investment for its communications infrastructure. Rather, PLC utilizes existing power lines, thereby forming a distribution network that already penetrates all residential, commercial and industrial premises. Accordingly, connectivity via PLC is potentially the most cost-effective, scalable interconnectivity approach for the IoT. We believe PLC can be an integral part of our communication infrastructure for the IoT, which enables reliable, real-time measurements, monitoring and control. A large variety of appliances may be interconnected by transmitting data through the same wires that provide electrical energy.